The Weekly Update

Week of March 9th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

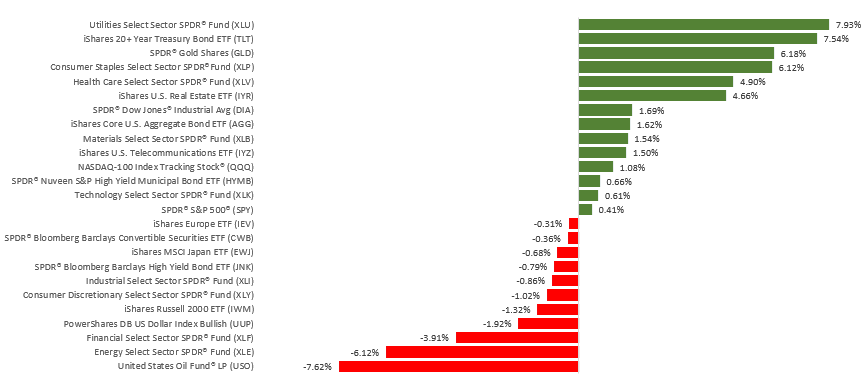

Heightened coronavirus fears, falling yields, and Super Tuesday primary results sent stocks on a rollercoaster ride of sharp price swings, leaving stocks marginally higher for the week.

The Dow Jones Industrial Average improved 1.79%; the S&P 500, 0.61%; the Nasdaq Composite, 0.10%. Outside the U.S., developed equity markets tracked by the MSCI EAFE Index rose 2.60%.

A Swift Fed Decision

Wednesday morning, the Federal Reserve lowered its short-term interest rate by 0.5% to a range of 1.00%-1.25%, making its biggest cut since 2008. Addressing the media, Fed Chairman Jerome Powell said that the move was made to give the economy a “meaningful” lift and “help boost household and business confidence.”

The question is whether reducing borrowing costs can effectively address growing business and consumer anxieties about shopping, traveling, and gathering.

A Push Toward Treasuries

The uncertainty on Wall Street has heightened demand for Treasury bonds. Their yields typically fall as their prices rise, and fall they did last week. The yield on the 10-year Treasury dipped under 0.70% during Friday’s market day, an all-time low.

Winter Hiring Surge Continues

The Department of Labor’s latest employment report showed companies adding 273,000 net new hires last month. Net monthly payroll growth has averaged 243,000 since December.

What’s Ahead

The Fed’s 50-basis-points cut in the federal funds rate has now shifted the sights of investors toward the European Central Bank, which is expected to make a policy announcement on March 12. The ECB has less room to maneuver than the Fed, since its key interest rate currently stands at -0.5%. Negative interest rates have done little to lift eurozone economies, which may necessitate more-creative monetary policy accommodation from the ECB’s new president, Christine Lagarde.

Traders are also focused on whether the Federal Reserve will make another rate cut on March 18, when its next meeting concludes. The half-point rate cut this past week did little to soothe stock market concerns; opinions vary about what the central bank might choose to do next.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The Census Bureau publishes a new Consumer Price Index, showing monthly and yearly inflation.

Friday: The University of Michigan presents its initial Consumer Sentiment Index for March, measuring consumer confidence.

Source: MarketWatch, March 6, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Thor Industries (THO)

Tuesday: Dick’s Sporting Goods (DKS)

Thursday: Adobe (ADBE), Broadcom (AVGO), Dollar General (DG), Oracle (ORCL), Ulta Beauty (ULTA)

Source: Zacks, March 6, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.