The Weekly Update

Week of August 16th, 2021

By Christopher T. Much, CFP®, AIF®

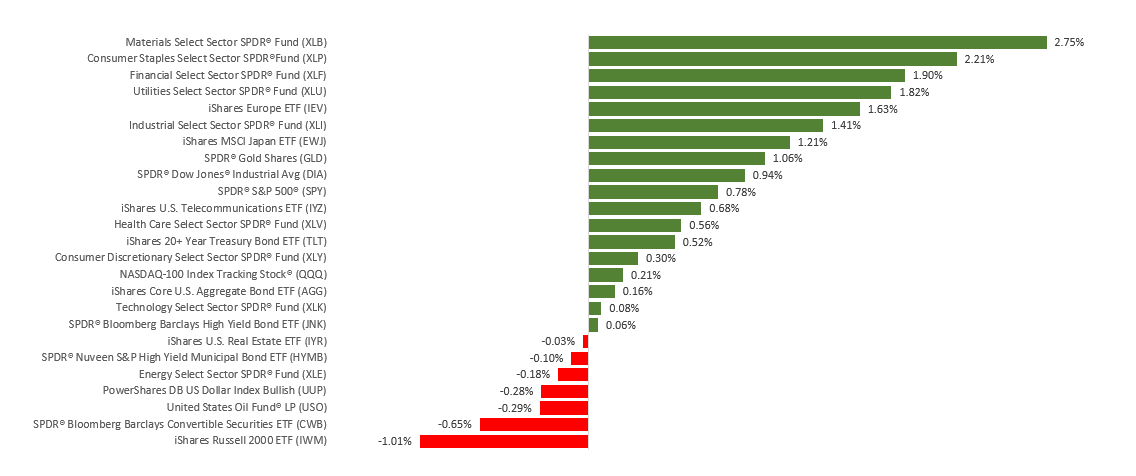

Looking past inflation figures and Delta variant trends, stocks last week found a way to climb higher and set fresh record highs in the process.

The Dow Jones Industrial Average rose 0.87%, while the Standard & Poor’s 500 advanced 0.71%. The Nasdaq Composite index was flat (-0.09%) for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.77%.

Quietly Climbing

Stocks moved higher amid relatively light trading last week. After initially retreating under the weight of Delta variant updates, stocks grinded higher, catalyzed by the Senate’s passage of a $1 trillion infrastructure bill.

Two themes emerged last week. The first was that inflation assumed a less threatening profile. The most recent Consumer Price Index report showed some moderation in consumer price increases, while investors appeared to interpret a hotter-than-expected Producer Price Index report as the peak in this inflation cycle.

Also worth noting were comments by multiple Federal Reserve Bank regional presidents suggesting that the time for tapering (i.e., ending the Fed’s bond purchases) was nearing, with one intimating that tapering could start as early as October.

Inflation Reports

Consumer prices climbed at their fastest rate since August 2008, rising 5.4% year-over-year. But this elevated rate was expected by most economists. The core inflation rate (excludes the more volatile food and energy prices) came in 4.3% higher, substantially lower than anticipated. This deceleration in core inflation was largely attributed to a slowdown in price increases in used cars and apparel.

More unsettling was the following day’s Producer Price Index (PPI). The PPI, which can be an indicator of future consumer prices, came in at the highest rate since tracking began, surging 7.8%.

This Week: Key Economic Data

Tuesday: Retail Sales. Industrial Production.

Wednesday: Housing Starts. FOMC (Federal Open Market Committee) Minutes.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Source: Econoday, August 13, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD), Agilent Technologies, Inc. (A), Roblox Corporation (RBLX).

Wednesday: Nvidia Corporation (NVDA), Cisco Systems, Inc. (CSCO), Target Corporation (TGT), Lowe’s Companies, Inc. (LOW).

Thursday: Ross Stores, Inc. (ROST), The Estee Lauder Companies, Inc. (EL).

Friday: Deere & Company (DE).

Source: Zacks, August 13, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.