The Weekly Update

Week of November 15th, 2021

By Christopher T. Much, CFP®, AIF®

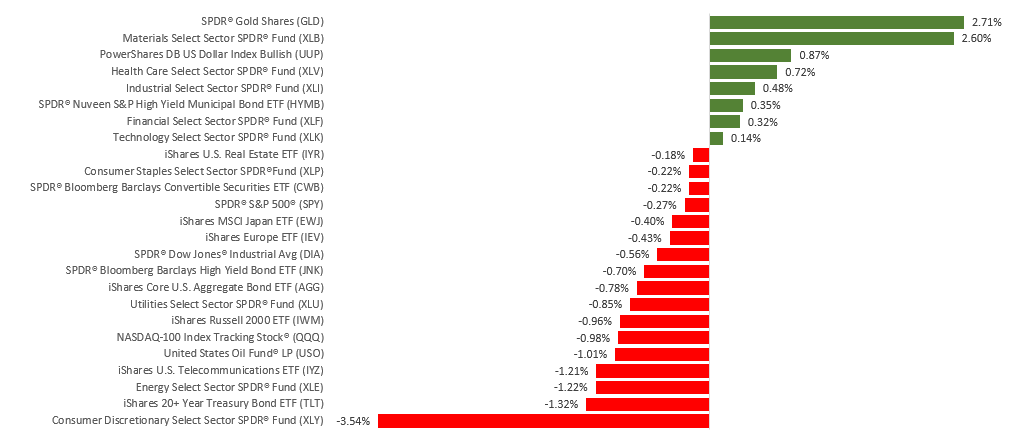

Stocks posted small declines last week as investors digested recent stock market gains and an unexpectedly high inflation read.

The Dow Jones Industrial Average slid 0.63%, while the Standard & Poor’s 500 retreated 0.31%. The Nasdaq Composite index slipped 0.69% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 0.78%.

Market Takes a Pause

After moving higher on Congressional approval of a $1 trillion-plus infrastructure spending bill, stocks drifted lower as investors took a breather after a weeks-long run-up in prices. A high October inflation report on Wednesday sent bond yields higher and stock prices lower, especially technology and other high growth companies. Energy also fell.

Higher-than-expected inflation elevated investor worries that the Fed may be forced to accelerate its bond tapering schedule and hike interest rates sooner than planned. Stocks found firmer footing following the inflation-related sell-off, closing the week on a strong note, though it wasn’t sufficient to keep stocks from ending the week in the red.

Hot! Hot! Hot!

Rising prices appear to be showing no signs of moderating. The first reading on inflation was Tuesday’s release of the Producer Price Index, which saw wholesale prices rise 0.6% in October and register an 8.6% increase from 12-months ago.

A day later the Consumer Price Index came in above consensus estimates, with prices climbing 0.9% from September 2021 and increasing 6.2% year-over-year. The 12-month increase was the sharpest such rise since 1990. The 12-month core inflation rate (excludes the more volatile food and energy sectors) was 4.6%, the fastest pace since 1991.

This Week: Key Economic Data

Tuesday: Retail Sales. Industrial Production.

Wednesday: Housing Starts.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Source: Econoday, November 12, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Lucid Group (LCID).

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD), NetEase, Inc. (NTES).

Wednesday: Nvidia Corporation (NVDA), Cisco Systems, Inc. (CSCO), Target Corporation (TGT), Lowe’s Companies, Inc. (LOW), The TJX Companies, Inc. (TJX).

Thursday: Palo Alto Networks, Inc. (PANW), Ross Stores, Inc. (ROST), JD.com (JD).

Source: Zacks, November 12, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.