The Weekly Update

Week of August 30th, 2021

By Christopher T. Much, CFP®, AIF®

The stock market powered to record levels last week amid talk of Fed tapering and a deceleration in new Delta variant cases.

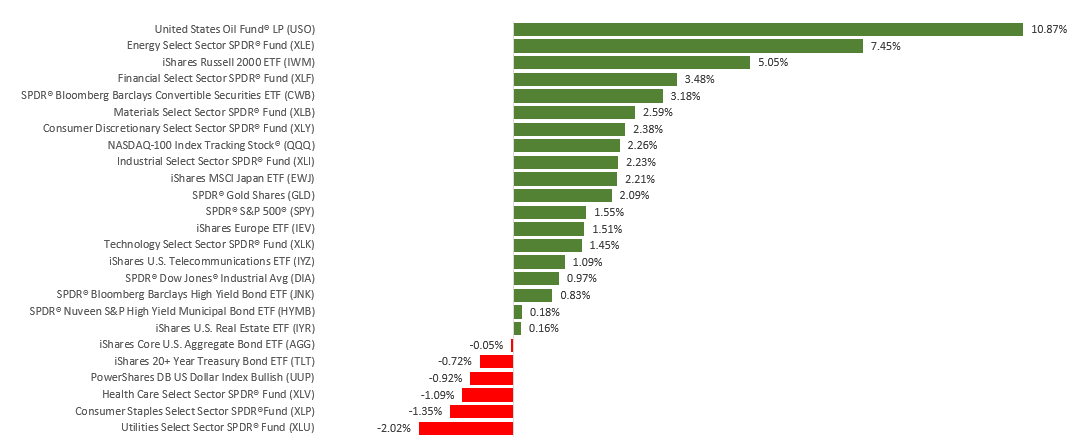

The Dow Jones Industrial Average gained 0.96%, while the Standard & Poor’s 500 increased 1.52%. The Nasdaq Composite index led, picking up 2.82%. The MSCI EAFE index, which tracks developed overseas stock markets, rose 1.39%.

Pushing Higher

Stocks surged to begin the week as investor sentiment improved on news of the FDA’s approval of its first COVID-19 vaccine, a strong housing number and comments by the Federal Reserve Bank-Dallas president that he would support delaying tapering if the Delta variant spread worsened.

Stocks continued their climb through midweek, pushing the S&P 500 to another record high and the NASDAQ Composite above 15,000 for the first time. The S&P 500 and NASDAQ Composite closed the week at record highs following Fed Chair Powell’s comments that Fed is likely to begin winding down its monthly bond purchases (aka tapering) by year-end, though no interest rate hikes were imminent.

Powell Speaks

At last week’s Jackson Hole Economic Policy Symposium, Fed Chair Jerome Powell’s speech on Friday provided further insights into Fed plans to begin tapering. Powell said that the Fed may likely commence tapering prior to year-end, adding that the wind down of bond purchases should not be seen as a signal for future rate hikes. Powell emphasized that labor market conditions remain short of the Fed’s target for maximizing employment. He also reiterated his case for why inflation remains a transitory phenomenon.

With several Regional Federal Reserve Bank presidents already supportive of tapering, investors may see more definitive steps coming out of next month’s FOMC (Federal Open Market Committee) meeting.

This Week: Key Economic Data

Tuesday: Consumer Confidence.

Wednesday: ISM (Institute for Supply Management) Manufacturing Index. ADP (Automated Data Processing) Employment Report.

Thursday: Jobless Claims. Factory Orders.

Friday: Employment Situation Report. ISM (Institute for Supply Management) Services Index.

Source: Econoday, August 27, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Zoom Video Communications, Inc. (ZM).

Tuesday: Netease, Inc. (NTES), Crowdstrike Holdings (CRWD).

Wednesday: Okta, Inc. (OKTA).

Thursday: Broadcom, Inc. (AVGO), Mongodb, Inc. (MDB), Docusign, Inc. (DOCU).

Source: Zacks, August 27, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.