The Weekly Update

Week of November 8th, 2021

By Christopher T. Much, CFP®, AIF®

A Federal Reserve announcement on tapering, a fresh batch of corporate profits, and encouraging economic data lifted stocks to another weekly gain.

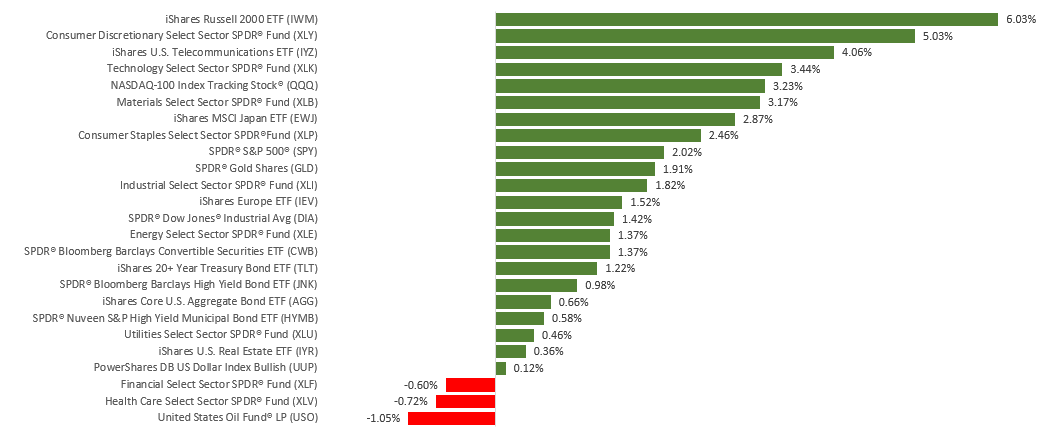

The Dow Jones Industrial Average rose 1.42%, while the Standard & Poor’s 500 advanced 2.00%. The Nasdaq Composite index led, tacking on 3.05%. The MSCI EAFE index, which tracks developed overseas stock markets, added 1.58%.

Stocks Power Higher

Stocks marched higher throughout the week, lifted by a succession of positive corporate earnings surprises, optimistic forward guidance by some companies, and healthy economic data. Continued strong third-quarter profits reinforced the narrative that businesses were able to meet strong consumer demand and maintain robust profit margins, despite the headwinds of inflation and supply-chain knots.

Investors were unfazed by the Fed’s mid-week announcement that it would begin its bond purchase tapering plans, in part, because it had long been telegraphed and Fed Chair Powell’s optimistic analysis of the current state of the economy. Also cheered was the announcement of a new COVID-19 antiviral pill and a powerful rebound in job creation, driving stocks to new heights to close out the week.

The Fed Speaks

In an eagerly awaited November meeting of the FOMC (Federal Open Market Committee), the Fed pulled the trigger on its plan to taper monthly bond purchases. Fed tapering will begin this month with reductions of $15 billion per month ($10 billion in Treasuries and $5 billion in mortgage-backed securities) that will end this pandemic-era policy response by July 2022.

The Fed reiterated its belief that inflation remained transitory, though conceding it had underestimated its acceleration and persistence; it did not expect interest rates to be raised until after the completion of the tapering program. Powell expects inflation to stay elevated until mid-2022 when he anticipates supply-chain bottlenecks to clear.

This Week: Key Economic Data

Monday: Consumer Price Index (CPI). Jobless Claims.

Friday: Consumer Sentiment. Job Openings and Labor Turnover Survey (JOLTS).

Source: Econoday, November 5, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: PayPal Holdings, Inc. (PYPL).

Tuesday: D.R. Horton, Inc. (DHI), Sysco Corporation (SYY), Palantir Technologies, Inc. (PLTR), DoorDash, Inc. (DASH), Coinbase Global, Inc. (COIN), Roblox Corporation (RBLX).

Wednesday: The Walt Disney Company (DIS), Affirm Holdings, Inc. (AFRM).

Friday: AstraZeneca PLC (AZN)

Source: Zacks, November 5, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.