The Weekly Update

Week of May 18th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks drifted lower last week, weighed down by Federal Reserve Chairman Jerome Powell’s unsettling comments on the economy and signs of renewed tensions with China.

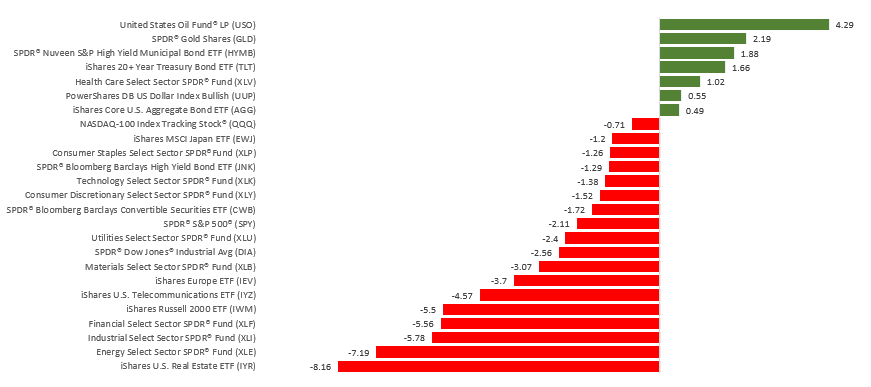

The Dow Jones Industrial Average fell 2.65%, while the Standard & Poor’s 500 retreated 2.26%. The Nasdaq Composite Index slipped 1.17% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, slid 3.66%.

Stocks Pull Back

Stocks moved lower throughout most of last week on worries that the emerging economic reopening might accelerate the spread of COVID-19. Comments by Fed Chair Powell added to the downside pressure when he expressed concern about the path ahead for the U.S. economy.

The stock market managed to find some firmer footing, posting a strong gain on Thursday. Stocks rallied again on Friday, overcoming headlines that suggested a souring relationship with China and a report that showed U.S. retail sales dropped 16.4% in April.

Powell Speaks

Fed Chair Powell spoke last Wednesday and painted a somber economic outlook, remarking that “the path ahead is highly uncertain and subject to significant downside risks.” He urged the White House and Congress to pass additional financial relief to help the economic recovery, adding that there was no plan on the Fed’s part to cut the federal funds rate to below zero.

Powell also referenced internal Fed research that found those least able to weather the current economic environment were most impacted, with nearly 40% of households making less than $40,000 per year having lost a job in March.

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Housing Starts.

Wednesday: FOMC (Federal Open Market Committee) Minutes.

Thursday: Jobless Claims. Existing Home Sales. Index of Leading Economic Indicators.

Source: Econoday, May 15, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Baidu (BIDU)

Tuesday: Walmart (WMT), Home Depot (HD)

Wednesday: Kohls (KSS), Target (TGT), Lowes Cos. (LOW), Expedia Group (EXPE)

Thursday: Nvidia (NVDA), TJX Cos. (TJX), Ross Stores (ROST), Intuit (INTU)

Friday: Deere (DE), Alibaba Group (BABA), Pinduoduo (PDD)

Source: Zacks, May 15, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.