The Weekly Update

Week of February 25, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

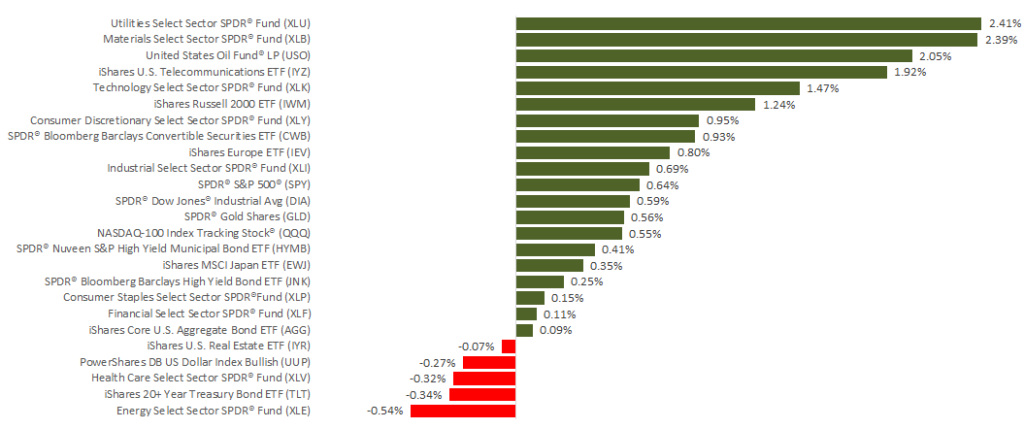

Stocks rallied last week as optimism about a potential U.S.-China trade deal grew. The S&P 500 advanced 0.80% during the 4-day trading week to 2,792.67. The Nasdaq Composite improved 0.86% to 7,527.54, and the Dow Jones Industrial Average gained 0.64% to 26,031.81.

The renewed prospects for a trade pact were not the only development investors found appealing last week. There were indications that the Federal Reserve might be a bit less committed to its plans to raise interest rates further this year.

A Look at the Fed Minutes

There were no surprises from the Federal Reserve’s Board of Governors, who released the transcript from their January meeting on Tuesday. Investors pore over the meeting minutes looking for clues about the Fed’s next move on short-term interest rates.

Fed policymakers appeared split on what’s next. Some felt another rate hike was needed to help slow the strong economy, while others favored a “wait-and-see” approach.

Home Sales Slump

In January, existing home sales were at their slowest pace since November 2015, and down 8.5% year-over-year. One factor: rising home values. Last month, the median single-family home sale price was $247,500, almost $7,000 higher than a year ago.

Mortgage rates have now fallen for three consecutive weeks, a development that may influence home buying decisions in coming months. Thursday, a Freddie Mac survey found the average interest rate on a 30-year, fixed-rate loan at just 4.35%.

Final Thought

The Dow Jones and Nasdaq have posted gains for nine straight weeks and are now at levels unseen since early November. Concerns over volatility have decreased, but that does not mean it is off the table. Whatever the market does in the coming weeks and months, remember your investing strategy should be based on your goals, risk tolerance, and time horizon.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Fed chair Jerome Powell begins two days of testimony on monetary policy in the Senate.

Wednesday: The National Association of Realtors releases its latest pending home sales index.

Thursday: The federal government provides its first estimate of fourth-quarter economic growth.

Source: Econoday / MarketWatch Calendar, February 22, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons, including the shutdown of the government agency or change at the private institution that handles the material.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: AutoZone (AZO), Home Depot (HD), Medpace (MEDP)

Wednesday: Apache (APA), Best Buy (BBY), Office Depot (ODP)

Thursday: Anheuser-Busch (BUD), Dell Technologies (DELL), Splunk (SPLK)

Source: Morningstar.com, February 22, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.