The Weekly Update

Week of June 1st, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

The shortened week, which began with a powerful two-day rally of trading, was enough to drive the markets into another week of solid gains.

The Dow Jones Industrial Average rose 3.75%, while the Standard & Poor’s 500 advanced 3.01%. The Nasdaq Composite Index climbed 1.77% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, gained 6.18%.

Rising Optimism

Returning from Memorial Day weekend, stocks surged on rising optimism over economic re-opening, declines in new infections, and progress in the development of a vaccine.

Stocks continued their march higher, lifted by signs that the White House and Congress may be working together to put together another stimulus package. But the momentum lost steam, in part due to news of China’s vote to override Hong Kong’s autonomy. Comments by President Trump on the last day of trading eased concerns.

Rotation in Leadership

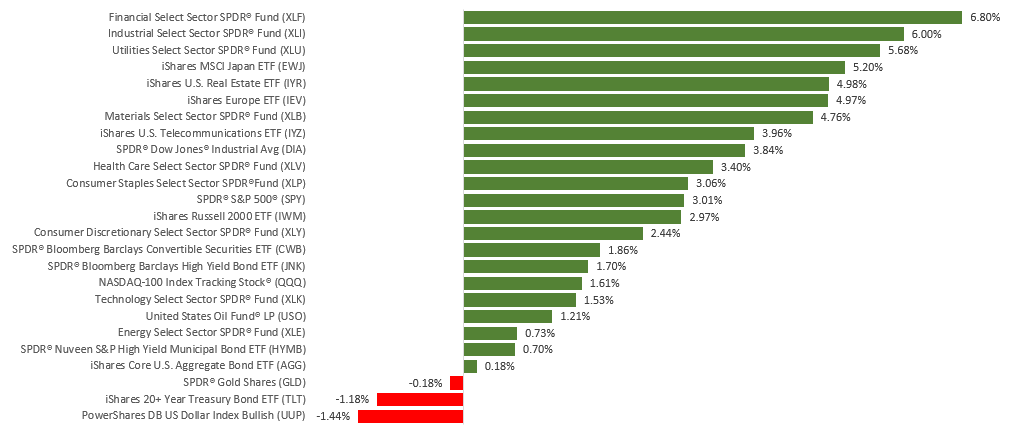

The recovery from the March lows has been powered by large-cap growth stocks, especially the mega-cap technology names. However, this week saw new sectors leading the market higher, notably the financials and industrials, while the technology and health care sectors lagged.

This leadership rotation is being referred to by some market commentators as the “re-opening trade.” If these sectors are to remain leaders, it may hinge on a steady economic recovery and escaping a second wave of COVID-19 infections.

THIS WEEK: KEY ECONOMIC DATA

Monday: Purchasing Managers Manufacturing Index (PMI). Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Automated Data Processing (ADP) Employment Report. PMI Services Index. ISM Non-Manufacturing Index.

Thursday: Jobless Claims.

Friday: Employment Situation Report.

Source: Econoday, May 29, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: Dick’s Sporting Goods (DKS), Tiffany (TIF), Zoom Video (ZM), Crowdstrike (CRWD)

Wednesday: Cloudera (CLDR), Campbell Soup (CPB)

Thursday: Broadcom (AVGO), Docusign (DOCU), Slack Technologies (WORK)

Source: Zacks, May 29, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.