The Weekly Update

Week of November 20th, 20223

By Christopher T. Much, CFP®, AIF®

Stocks extended their November rally last week as investors cheered lower-than-forecast inflation data.

The Dow Jones Industrial Average gained 1.94%, while the Standard & Poor’s 500 added 2.24%. The Nasdaq Composite index rose 2.37% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, increased 3.36%.

Stocks March Higher

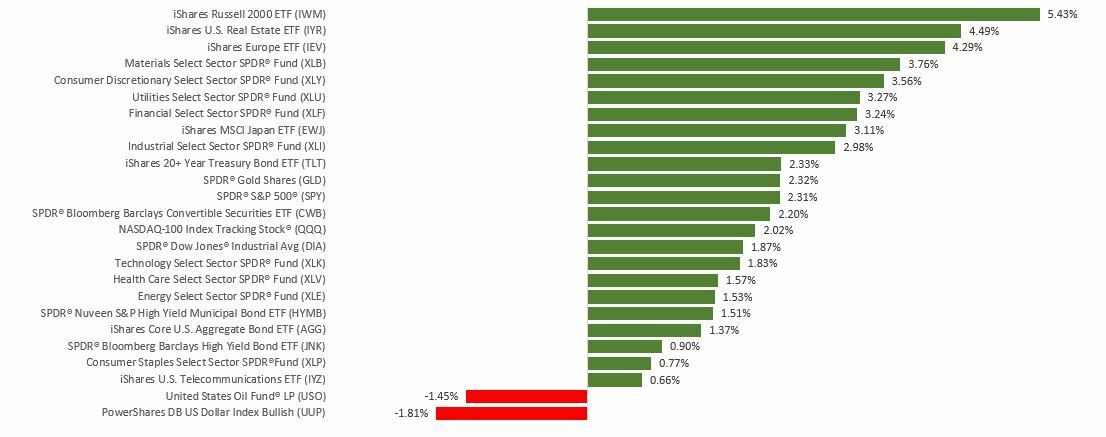

A better-than-anticipated consumer inflation number on Tuesday sent bond yields sharply lower, igniting a powerful, exceptionally broad-based rally that saw 91% of all New York Stock Exchange volume advancing in price and a similarly substantial advance (85%) on the NASDAQ. Small-cap stock performance was solid, surging 5.2%, more than double the advance of the S&P 500.

Further gains came the following day as wholesale price inflation rose even slower than consumer prices. The rally paused in the final days of trading as stocks digested their gains and investors assessed weak retail sales and industrial production reports and a rise in continuing jobless claims.

Inflation Cools

Two inflation reports released last week, the Consumer Price Index (CPI) and the Producer Price Index (PPI), showed continued inflation progress. Consumer prices were flat in October from the previous month, while the 12-month increase was 3.2%. Both were below market forecasts. Core CPI (excluding food and energy) also moderated, rising just 0.2% in October and 4.0% from a year ago–below forecast. The climb in the annual core CPI was the lowest in two years.

Producer prices confirmed the disinflationary picture, as wholesale prices declined 0.5% in October (versus a +0.1% forecast). It was the biggest decline in 3 ½ years. Over the last 12 months, wholesale prices rose just 1.3%.

This Week: Key Economic Data

Tuesday: Existing Home Sales. FOMC Minutes.

Wednesday: Durable Goods Orders. Jobless Claims. Consumer Sentiment.

Friday: Purchasing Managers’ Index Composite Flash.

Source: Econoday, November 17, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: Agilent Technologies, Inc. (A)

Tuesday: Nvidia Corporation (NVDA), Lowe’s Companies, Inc. (LOW), Analog Devices, Inc. (ADI)

Wednesday: Deere & Company (DE)

Source: Zacks, November 17, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.