The Weekly Update

Week of September 9th, 2022

By Christopher T. Much, CFP®, AIF®

In a holiday-shortened week of trading, stocks posted healthy gains despite more tough talk on monetary policy from Fed officials.

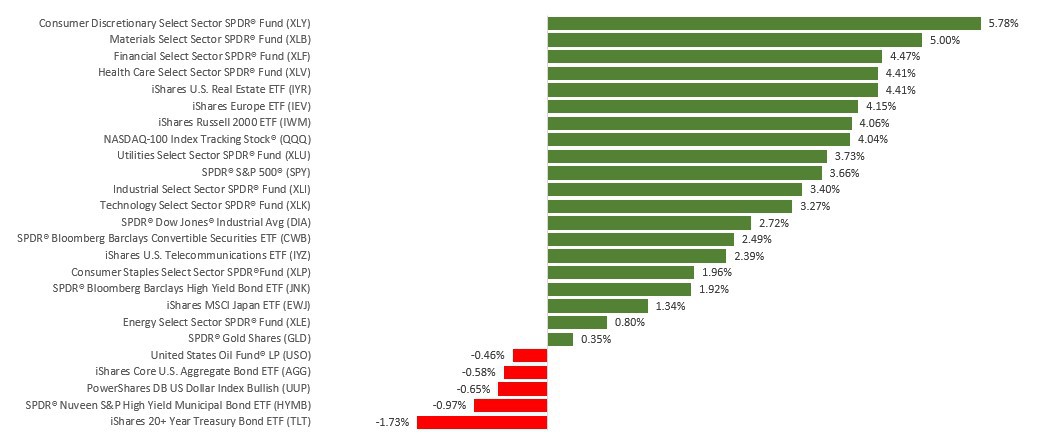

The Dow Jones Industrial Average rose 2.66%, while the Standard & Poor’s 500 gained 3.65%. The Nasdaq Composite index picked up 4.14% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 1.26%.

Stocks Rise

Stocks fell coming off the Labor Day weekend, dragged down by news that Russia was cutting off natural gas supplies to its European customers. Stocks also were under pressure due to a surprisingly strong report on business conditions, which heightened fears of continued Fed hawkishness.

Sentiment quickly improved as bond yields turned lower and oil prices fell. Investors reacted positively to comments by Fed Vice Chair Lael Brainard, who reiterated the Fed’s commitment to quashing inflation while acknowledging the risks of going too far. Stocks added to their gains on Thursday as the market digested another speech from Fed Chair Powell and a 0.75% hike by the European Central Bank. The markets surged on Friday amid little news, ending a positive week on an upbeat note.

No Inflation Walk Back

In his first public comments since his speech at Jackson Hole that sent markets into a tailspin, Fed Chair Powell did not seek to soften the edges of the Fed’s commitment to fighting inflation. In an interview on Thursday, Powell reaffirmed the need for sustained and robust actions to bring down inflation. He emphasized that it was critical that “the longer inflation remains well above target, the greater the risk the public does begin to see higher inflation as the norm, and that has the capacity to really raise the costs of getting inflation down.”

With the Federal Open Market Committee (FOMC) set to meet on September 20-21, these comments may indicate that market expectations of a rate hike of 0.75% this month align with the Fed’s plans.

This Week: Key Economic Data

Tuesday: Consumer Price Index (CPI).

Wednesday: Producer Price Index (PPI).

Thursday: Retail Sales. Industrial Production. Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, September 9, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Oracle Corporation (ORCL).

Source: Zacks, September 9, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.