The Weekly Update

Week of October 26th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

The failure to reach an agreement on a new fiscal stimulus bill soured investor sentiment and sent stocks modestly lower for the week.

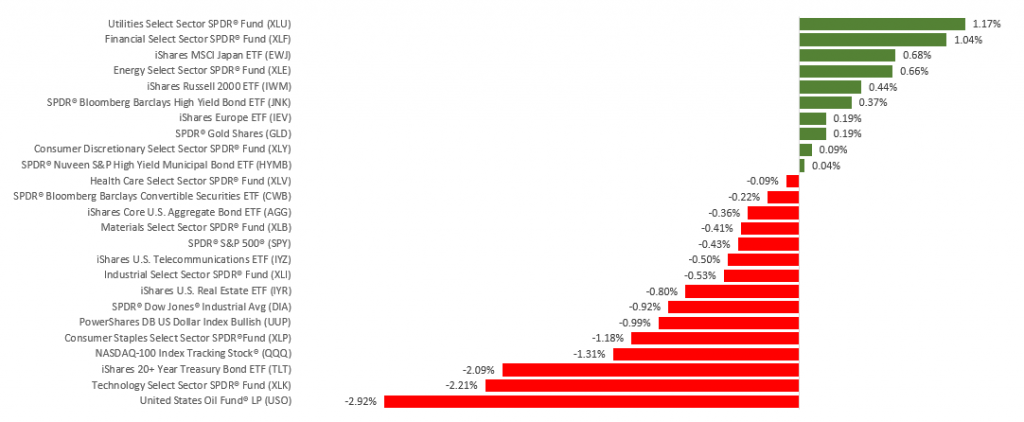

The Dow Jones Industrial Average fell 0.95%, while the Standard & Poor’s 500 lost 0.53%. The Nasdaq Composite index slipped 1.06% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, declined 0.44%.

Markets Disappointed with Stimulus Impasse

Stock prices ebbed and flowed all week, pulled by the gravity of fiscal stimulus talks in Washington, D.C. As investors saw improving prospects for a new fiscal stimulus bill, stocks rose. As prospects dimmed, stocks turned lower.

Hopes for striking a deal were raised late in the week as comments from a key negotiator suggested that a deal might be getting closer to fruition. The week ended, however, without an agreement, cementing a disappointing week of performance.

Market sentiment was further weighed down by the continued rise in COVID-19 cases in the U.S. and Europe, though anxieties were tempered by the belief that a full economic lockdown was unlikely.

New Jobless Claims Fall

Markets have been focused on weekly initial jobless claims as an important input into the state of economic recovery. After weeks of 800,000+ new jobless claims, last week’s report reflected an improving labor market, as new jobless claims rose by 787,000, below consensus estimates of 875,000, while continuing jobless claims fell by more than one million.

The report wasn’t entirely positive, however, as more than 500,000 individuals were added to the emergency assistance program that extends unemployment benefits to those who have run out of state unemployment benefits.

THIS WEEK: KEY ECONOMIC DATA

Monday: New Home Sales.

Tuesday: Durable Goods Orders. Consumer Confidence.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, October 23, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Twilio, Inc (TWLO).

Tuesday: Microsoft (MSFT), Pfizer (PFE), Caterpillar (CAT), Merck (MRK), Eli Lilly (LLY), 3M Company (MMM), Corning Inc. (GLW)

Wednesday: General Electric (GE), The Boeing Corporation (BA), Ford Motor Company (F), Visa (V), Mastercard (MA), Gilead Sciences (GILD), Blackstone Group (BX), Amgen (AMGN), United Parcel Services (UPS), EBay (EBAY), Norfolk Southern (NSC)

Thursday: Apple (AAPL), Facebook (FB), Twitter (TWTR), Alphabet, Inc. (GOOGL), Southern Company Airlines (SO), Shopify (SHOP), Comcast Corporation (CMCSA), AnheuserBusch InBev (BUD)

Friday: Abbvie (ABBV), Chevron (CVX), Charter Communications (CHTR)

Source: Zacks, October 23, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.