The Weekly Update

Week of July 5th, 2022

By Christopher T. Much, CFP®, AIF®

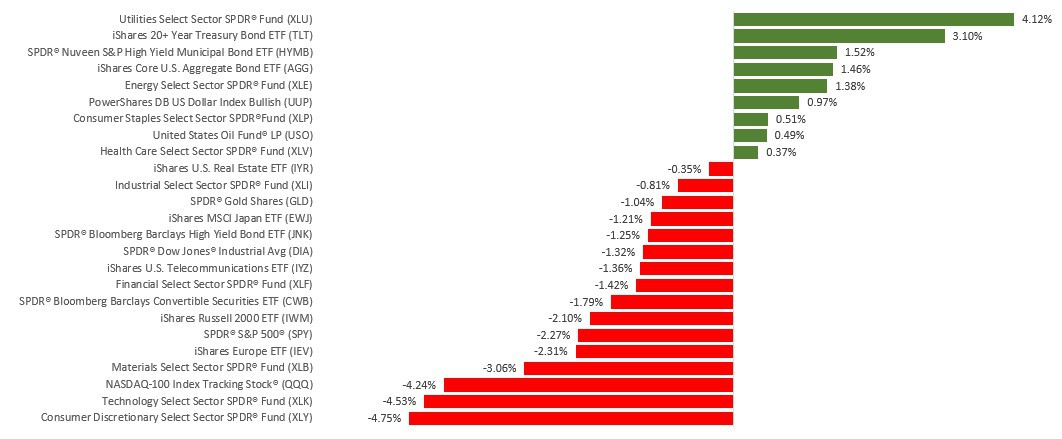

After the S&P 500 posted its worst first half of the year since 1970, U.S. stock futures are starting the new month and new quarter under pressure.

All three major U.S. stock indexes finished the month and the second quarter in negative territory last week. For the month, the S&P 500 fell 8.4%, the Nasdaq declined 8.7%, and the Dow lost 6.7%.

It was the largest first-half percentage drop ever for the Nasdaq, while the Dow plunged the most since 1962. For the first half of 2022, the S&P 500 fell 20.6%, the Nasdaq lost 29.5%, and the Dow declined 15.3%. All three indexes posted their second straight quarterly declines. The last time that happened was in 2015 for the S&P 500 and the Dow, and 2016 for the Nasdaq. For the quarter, the S&P 500 declined 16.4%, the Nasdaq lost 22.4%, and the Dow fell 11.2%.

Treasury yields slid on Friday for the third straight day following soft consumer spending and elevated inflation data. The yield on the 10-year Treasury is back below 3% at 2.97%.

Oil Falls

Oil prices tumbled as OPEC and its allies confirmed it would only increase production in August as much as previously announced, despite tight global supplies. Light sweet crude is now at $107 per barrel.

Crypto Follows Suit

Last week, Bitcoin posted its worst quarter since 2011, and its worst month ever. Today, it is trading back above $19,500, while Ether is just above $1,000.

The Institute for Supply Management reported its index of national factory activity fell to a reading of 53% in June, from 56.1 in May. The S&P Global Manufacturing PMI fell to 52.7 in June, down from 57.0 in May. The Commerce Department reported on construction spending for May, which was $1,779.9 billion, and revised the April 2022 report to $1,782.5 billion.

This Week: Key Economic Data

Tuesday: Motor Vehicle Sales, Factory Orders

Wednesday: ISM Services Index, JOLTS, FOMC Minutes

Thursday: ADP Employment Report, EIA Natural Gas Report

Source: Econoday, July 1, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Daikin Industries (DKILY), DSV (DSDVY), Sonova Holding (SONVY), Porche Automobil Holding SE (POAHY)

Wednesday: Oriental Land (OLCLY), A.P. Moller-Maersk (AMKBY), Adyen (ADYEY), Stellantis (STLA), Intesa Sanpaolo (ISNPY)

Thursday: Next (NXGPY), Levi Strauss & Co. (LEVI), Helen of Troy (HELE), WD40 (WDFC)

Friday: Yaskawa Electric (YASKY), Elekta (EKTAY)

Source: Zacks, July 1, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.