The Weekly Update

Week of October 16, 2017

By Christopher T. Much, CFP®, AIF®

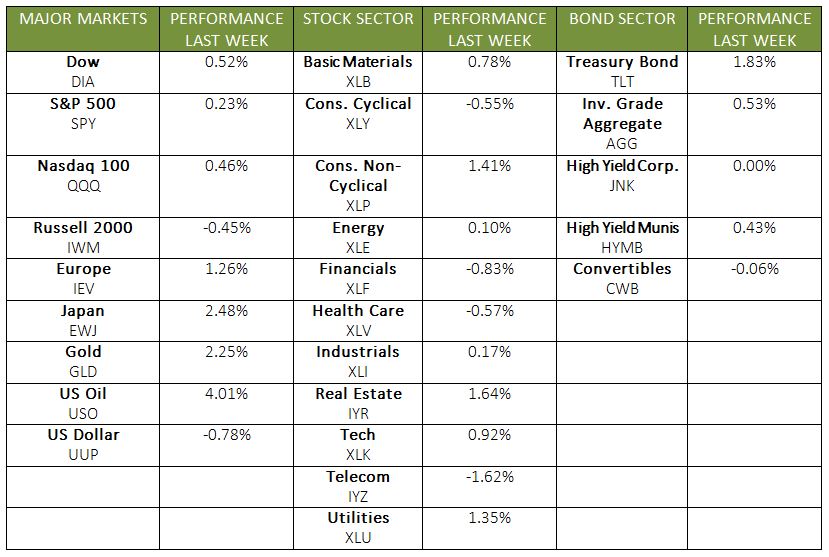

Last Friday, all 3 major domestic indexes continued their streak of weekly gains and record highs. The S&P 500 added 0.15%, and the Dow was up 0.43%. Meanwhile, both indexes posted their 5th weekly gain in a row. In addition, the S&P 500 and Dow each hit intraday trading records on Friday. The NASDAQ also increased 0.24%, ending on a record high with a 3rd straight week of growth. International stocks in the MSCI EAFE rose as well, gaining 1.61% for the week.

What drove market performance last week?

We received a number of new reports last week, including data showing jumps in the Producer Price Index, Consumer Price Index, and Retail Sales. Recovery efforts from hurricanes contributed to the gains in all three of these readings. And they could continue to affect the markets for a while.

In addition to this new data, two key events contributed to the markets’ continuing growth: 1) a positive start to earnings season and 2) high consumer sentiment numbers.

- Earnings Season Started Strong

Companies have started releasing their 3rd quarter earnings reports, and so far, 87% of them beat bottom-line expectations. Corporate earnings have been strong since Q4 2016, and this quarter will likely continue that trend. However, the growth rate may not match what we have seen for the past few earnings seasons. - Consumer Sentiment Hit 13-Year High

After 8 years of economic growth, many consumers are feeling more content about their circumstances. The University of Michigan’s consumer sentiment poll for September revealed that consumers held positive perspectives overall—across income, age, and political spectrums. Last month’s reading has the highest consumer sentiment since 2004.

We believe that the ongoing record highs we are witnessing are a good reminder to not let headlines or fear drive your financial choices. This year has certainly provided a variety of geopolitical drama to distract from the economic fundamentals. Nonetheless, in 2017, U.S. share prices have gained $3 trillion in value so far. At the same time, investors have taken $45 billion out of their ETFs and mutual funds—essentially missing this market rally.

Investors exit markets for myriad reasons. But when emotion drives choices, rather than true strategy, those decisions can have a lasting effect on long-term goals. If you have questions about how the markets are performing—or what choices you should be considering right now—we are always here to talk.

ECONOMIC CALENDAR

Tuesday: Industrial Production, Housing Market Index

Wednesday: Housing Starts

Thursday: Jobless Claims

Friday: Existing Home Sales