The Weekly Update

Week of November 4th, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

A better-than-forecast jobs report prompted a stock market rally Friday, two days after traders witnessed another interest rate cut by the Federal Reserve.

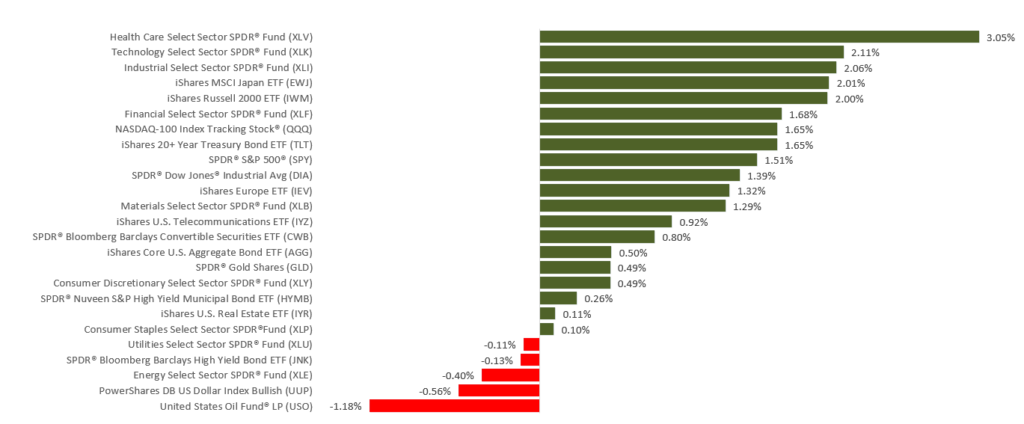

Both the S&P 500 and Nasdaq Composite ended the week at historic peaks, while the Dow Jones Industrial Average settled less than 12 points under its all-time record close. The Nasdaq rose 1.74% for the week; the S&P gained 1.47%. The Dow added 1.44%. MSCI’s EAFE benchmark, which measures developed stock market performance outside the U.S. and Canada, improved 0.58%.

Economy Adds 128,000 Jobs in October

This net increase far surpassed the gain of 85,000 projected by a Bloomberg poll of economists. These job gains occurred even as last month’s General Motors strike impacted hiring in the manufacturing sector.

Unemployment rose slightly to 3.6% in October, an effect of more people entering the job market. Likewise, the U-6 rate, counting both unemployed and underemployed, Americans ticked up to 7.0%.

The Fed’s Latest Interest Rate Decision

Last week, the central bank made its third quarter-point rate cut since July, leaving the target range for the federal funds rate at 1.50-1.75%.

Something was missing from the latest Fed policy statement. Since June, a passage had noted that the Fed was ready to “act as appropriate to sustain the expansion.” In the latest statement, that language disappeared. At a press conference Wednesday, Fed Chair Jerome Powell commented that Fed officials “see the current stance of monetary policy as likely to remain appropriate.”

Where Trade Talks with China Stand

There were further negotiations between U.S. and Chinese officials Friday, and China’s commerce ministry announced that both sides had “reached consensus on principles” integral to the first phase of a new trade pact. U.S. Trade Representative Robert Lighthizer noted only that the latest round of conversation had brought “progress in a variety of areas.”

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Institute for Supply Management presents its latest Purchasing Managers Index for the U.S. service sector, gauging business activity and new orders.

Friday: The University of Michigan’s preliminary November Consumer Sentiment Index appears, measuring consumer confidence levels.

Source: Econoday, November 1, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Marriott International (MAR), Sysco (SYY), Uber (UBER)

Tuesday: Allergan (AGN), Toyota (TM)

Wednesday: CVS Health (CVS), Qualcomm (QCOM)

Thursday: Booking Holdings (BKNG), Walt Disney Co. (DIS)

Friday: Duke Energy (DUK), Enbridge (ENB), Honda (HMC)

Source: Zacks, November 1, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.