The Weekly Update

Week of July 21st, 2025

By Christopher T. Much, CFP®, AIF®

Stocks were mixed last week, battling through tariff talk while responding to upbeat quarterly corporate reports and a trove of updates on the economy.

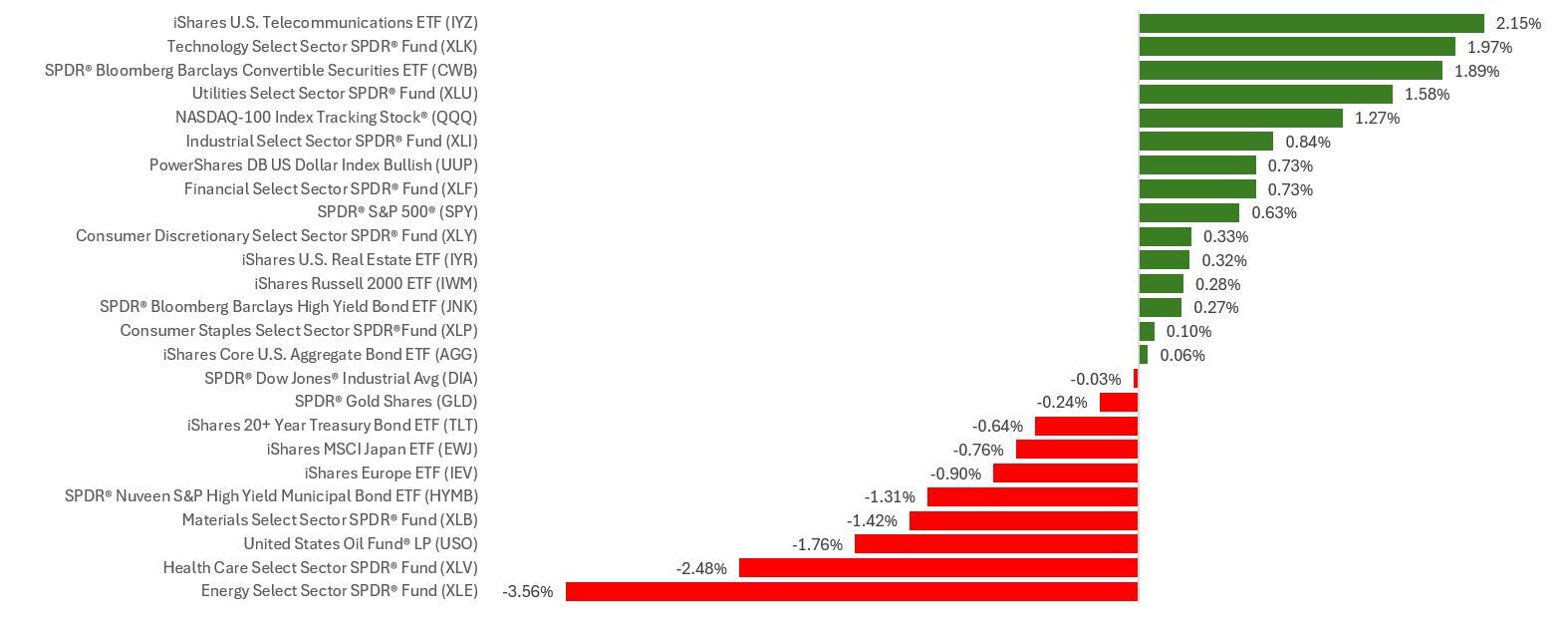

The Standard & Poor’s 500 Index rose 0.59 percent, while the Nasdaq Composite Index added 1.51 percent. The Dow Jones Industrial Average decreased 0.07 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, skidded 0.46 percent.

Economic News

All three major market averages posted modest gains to start the week as investors appeared to shrug off tough talk on trade from the White House over the weekend.

Stocks mostly fell after news that inflation warmed up a bit last month albeit in line with economists’ expectations. A narrow, chip-led rally developed after a megacap chipmaker said it received assurances from the White House of its ability to sell products in China, pushing the Nasdaq modestly higher.

Stocks continued their climb over the next session following news that consumer spending rebounded last month as trade talk slowed. The S&P 500 posted another record close amid several companies beating expectations as they reported quarterly financials.

Markets went slightly lower on Friday despite news that consumer sentiment rose last month. The consumer sentiment report also showed a drop in concerns about tariff-induced inflation.

Splitting the Difference

Two themes developed with fresh economic data released last week: inflation and consumers.

First, June inflation data painted a mixed picture. While consumer prices rose at a 2.7 percent annual clip last month (faster than May’s 2.4 percent rate), wholesale inflation was flat. So while retail prices were a concern, wholesale prices currently suggest a muted effect from tariffs.

The second theme revolved around consumers, who continued to be a source of strength for the economy. Retail sales recovered in June, and while they were still lower than at year-end, consumer sentiment rose to its highest level since February.

This Week: Key Economic Data

Monday: Leading Economic Indicators.

Tuesday: Fed Chair Powell banking conference speech. Fed Official Michelle Bowman speaks.

Wednesday: Existing Home Sales. Treasury Buyback.

Thursday: Jobless Claims (weekly). Services & Manufacturing PMI. New Home Sales. Fed Balance Sheet.

Friday: Durable Goods.

Source: Investor’s Business Daily – Econoday economic calendar; July 18, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Verizon Communications Inc. (VZ)

Tuesday: The Coca-Cola Company (KO), Philip Morris International Inc. (PM), RTX Corporation (RTX), Texas Instruments Incorporated (TXN), Intuitive Surgical, Inc. (ISRG), Danaher Corporation (DHR), Lockheed Martin Corporation (LMT)

Wednesday: Alphabet Inc. (GOOG/GOOGL), Tesla, Inc. (TSLA), International Business Machines Corporation (IBM), T-Mobile US, Inc. (TMUS), ServiceNow, Inc. (NOW), AT&T Inc. (T), Thermo Fisher Scientific Inc. (TMO), NextEra Energy, Inc. (NEE), Boston Scientific Corporation (BSX), GE Vernova Inc. (GEV), Amphenol Corporation (APH), CME Group Inc. (CME)

Thursday: Honeywell International Inc. (HON), Union Pacific Corporation (UNP), Blackstone Inc. (BX), Intel Corporation (INTC)

Source: Zacks, July 18, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.