The Weekly Update

Week of August 13, 2018

By Christopher T. Much, CFP®, AIF®

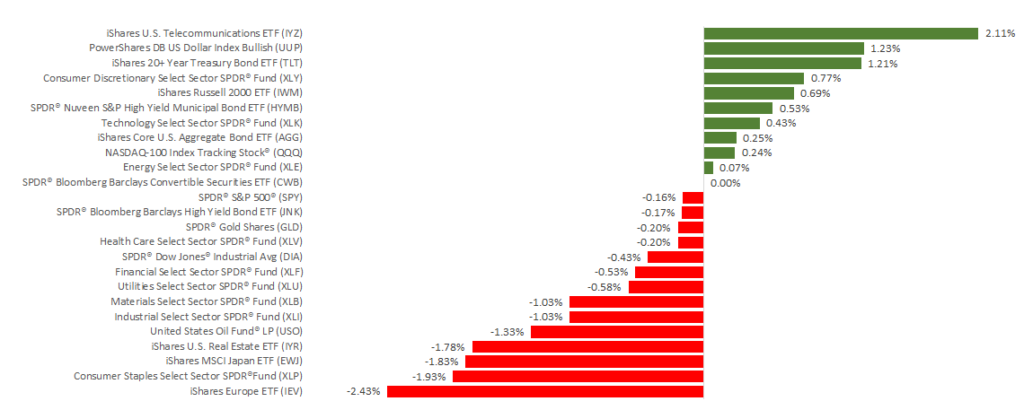

Stocks ended the week in mixed territory as trouble with Turkey’s currency affected U.S. equity performance on Friday, August 10. For the week, the S&P lost 0.25%, the Dow declined 0.59%, and the NASDAQ increased 0.35%. International stocks in the MSCI EAFE stumbled, giving back 1.57%.

Although last week brought relatively few economic updates, we did learn that the labor market continues to improve, and consumer prices are on the rise. While this news may have affected market performance, the challenges facing Turkey’s economy had an outsize impact on global stocks.

What happened to the Turkish lira?

The Turkish lira dropped 14% to 6.46 per dollar, the weakest on record with the largest drop in more than 17 years. The lira ended the week at a record low against the U.S. dollar. Tension between the U.S. and Turkey played a part in the decline as President Trump tweeted plans to double tariffs on Turkish steel and aluminum imports. This potential tariff hike followed a stalled conversation between the two countries concerning an imprisoned U.S. pastor who Turkey believes supported a 2016 attempted coup.

How did investors react?

The resulting drop in the lira’s value concerned investors and led to losses in markets worldwide. Friday, the S&P 500 marked its largest daily decline since June after getting close to a new record high.

Why do investors care?

The lira’s drop is another sign that emerging markets are experiencing challenges in their economies. Some investors worry that Turkey’s economic crisis could spread to other countries or affect interest in other emerging markets.

Should you be concerned?

Probably not for now. U.S. companies don’t have a tremendous amount of exposure to Turkish markets.

We know that global dynamics can be complex and understanding their specific effects on your financial life may seem challenging. If you have any questions, contact us any time.

ECONOMIC CALENDAR:

Tuesday: Import and Export Prices

Wednesday: Retail Sales, Industrial Production, Housing Market Index

Thursday: Housing Starts, Jobless Claims

Friday: Consumer Sentiment