The Weekly Update

Week of February 21st, 2023

By Christopher T. Much, CFP®, AIF®

Growing concerns about further interest rate hikes, prompted by fresh economic data, reversed early-week gains and left stocks mixed for the week.

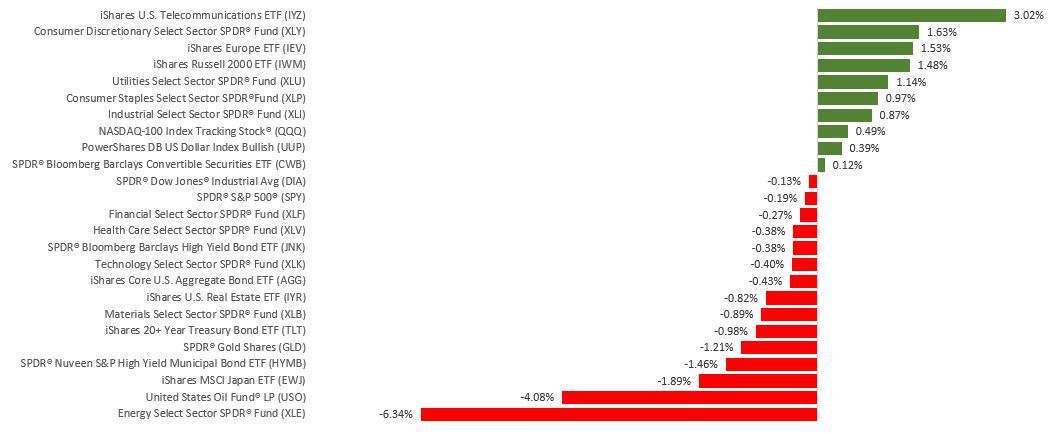

The Dow Jones Industrial Average slipped 0.13%, while the Standard & Poor’s 500 fell 0.28%. The Nasdaq Composite index advanced 0.59% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.52%.

Rate Concerns Weigh On Stocks

Stocks opened last week higher on investor hopes that a continued cooling in inflation might support a more dovish Fed. A higher-than-expected rise in the Consumer Price Index (CPI) and strong retail sales in January initially did little to dent that enthusiasm, as stocks posted solid gains through Wednesday’s close.

But that optimism faded on Thursday as a surprising rise in producer prices and another decline in initial jobless claims triggered worries the Fed would stay the course for longer. Comments from two Fed officials supporting a more aggressive rate hike stance added to the unease, erasing much of the week’s gains. Stocks ended mixed on Friday, capping a choppy week.

Inflation Moderation Pauses

Consumer prices climbed 0.5% in January, fueled by rising shelter costs and energy prices. The increase in the CPI was higher than the 0.1% rise in December and slightly above the consensus estimates of 0.4%. The year-over-year inflation number (6.4%) came in lower than December’s 12-month rise of 6.5%, making it the seventh consecutive month of declining year-over-year inflation.

January’s product price report showed a surprise 0.7% increase, higher than the 0.4% rise expected by economists and the biggest jump since June. Year-over year, producer prices rose 6.0%, a slight improvement from December’s number.

This Week: Key Economic Data

Tuesday: Purchasing Managers’ Index (PMI) Flash. Existing Home Sales.

Wednesday: FOMC Minutes.

Thursday: Jobless Claims. Gross Domestic Product (GDP).

Friday: New Home Sales. Consumer Sentiment.

Source: Econoday, February 17, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD), Palo Alto Networks, Inc. (PANW).

Wednesday: eBay, Inc. (EBAY), The TJX Companies, Inc. (TJX), Nvidia Corporation (NVDA), Diamondback Energy, Inc. (FANG).

Thursday: Block, Inc. (SQ), Pioneer Natural Resources Company (PXD).

Friday: EOG Resources, Inc. (EOG).

Source: Zacks, February 17, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.