The Weekly Update

Week of May 23rd, 2022

By Christopher T. Much, CFP®, AIF®

Recession fears grew last week following weak earnings reports from major retailers, sending stocks lower.

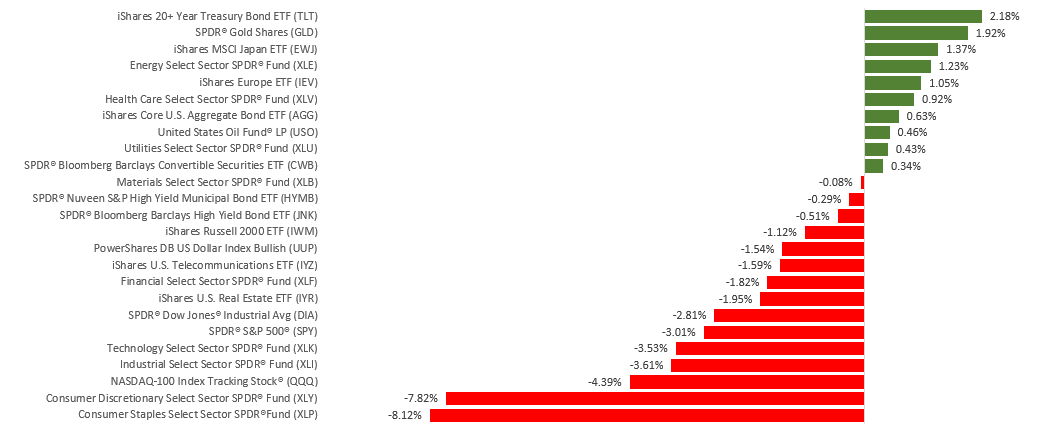

The Dow Jones Industrial Average fell 2.90%, while the Standard & Poor’s 500 lost 3.05%. The Nasdaq Composite index dropped 3.82% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.84%.

Trending Lower

Stock prices remained in a downtrend, capped by a sell-off on Wednesday following a succession of disappointing earnings reports from several major retailers. Despite solid April retail sales and industrial production data, weak economic numbers from China and shrinking profit margins at U.S. retailers fanned recession fears throughout the week.

Rising yields, which have been an overhang to the markets in recent weeks, turned lower as investors appeared to move cash to bonds from stocks. But lower yields did not help stock prices, which closed out the week with a volatile trading session.

Cloudy Picture with Retailers

Investors received a mixed message from the retail sector. April’s retail sales increased 0.9% from March, signifying that consumer spending remained strong. But it was difficult to determine from the retail sales report whether the increase was a function of higher retail prices or a resilient consumer.

It was also a big week for earnings reports from some of the nation’s largest retailers. Results were disappointing as retailers struggled with supply chain issues, higher costs, and misaligned product mix. Some retailers indicated a drop in the number of transactions, suggesting that shoppers reduce purchases due to higher prices on essential items.

This Week: Key Economic Data

Tuesday: Purchasing Managers’ Index (PMI) Composite Flash. New Home Sales.

Wednesday: Federal Open Market Committee (FOMC) Minutes. Durable Goods Orders.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, May 20, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Zoom Video Communications (ZM).

Tuesday: Best Buy Co., Inc. (BBY), AutoZone, Inc. (AZO), Intuit, Inc. (INTU).

Wednesday: Nvidia Corporation (NVDA), Snowflake, Inc. (SNOW).

Thursday: Costco Wholesale Corporation (COST), Marvell Technology, Inc. (MRVL), Workday, Inc. (WDAY), Dollar General Corporation (DG), Dell Technologies, Inc. (DELL), VMware, Inc. (VMW).

Source: Zacks, May 20, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.