The Weekly Update

Week of March 27th, 2023

By Christopher T. Much, CFP®, AIF®

Modest gains in major market indices masked sharp volatility amid the uncertainty arising from mixed messages emanating from public officials and revived banking fears.

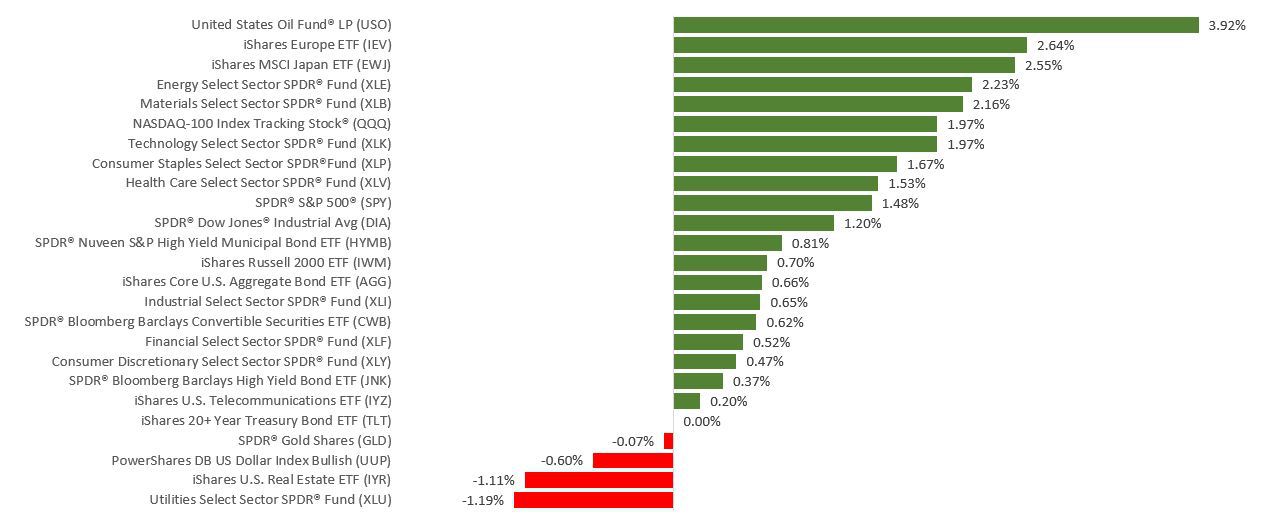

The Dow Jones Industrial Average gained 1.18%, while the Standard & Poor’s 500 added 1.39%. The Nasdaq Composite index rose 1.66% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced by 3.29%.

A Turbulent Week For Stocks

The stock market was unable to find sustained direction as investors weighed comments from Fed Chair Jerome Powell and Treasury Secretary Janet Yellen. Stocks initially rose as banking fears eased following a deal to acquire a troubled Swiss bank. Optimism was further fueled by Yellen, who said the government could intervene to protect depositors if more bank issues materialized.

Enthusiasm faded, however, when Yellen subsequently testified that the Treasury was not working on any blanket insurance for bank deposits and by the Fed’s warning that banking turmoil could shrink lending access — the volatile week ended with sharp intraday price swings, shrugging off revived European banking concerns.

Rate Hike Cycle Ending?

Last week, the Federal Open Market Committee (FOMC) meeting was particularly noteworthy. Fed officials were placed in the difficult position of balancing the banking system’s opposing risks of still-high inflation and stressors. The Committee had considered leaving rates unchanged given banking stressors but unanimously voted to raise rates by 0.25%, citing elevated inflation, resilient economic activity, and a strong labor market.

The official announcement hinted that the Fed might soon be done with raising rates while also stating it was too early to ascertain the degree to which the economy could slow from the current banking strains.

This Week: Key Economic Data

Tuesday: Consumer Confidence.

Thursday: Jobless Claims. Gross Domestic Product (GDP).

Friday: Personal Income and Outlays. Consumer Sentiment.

Source: Econoday, March 25, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Micron Technology, Inc. (MU), Walgreens Boots Alliance, Inc. (WBA).

Source: Zacks, March 25, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.