The Weekly Update

Week of June 12, 2017

By Christopher Much, CFP®, AIF®

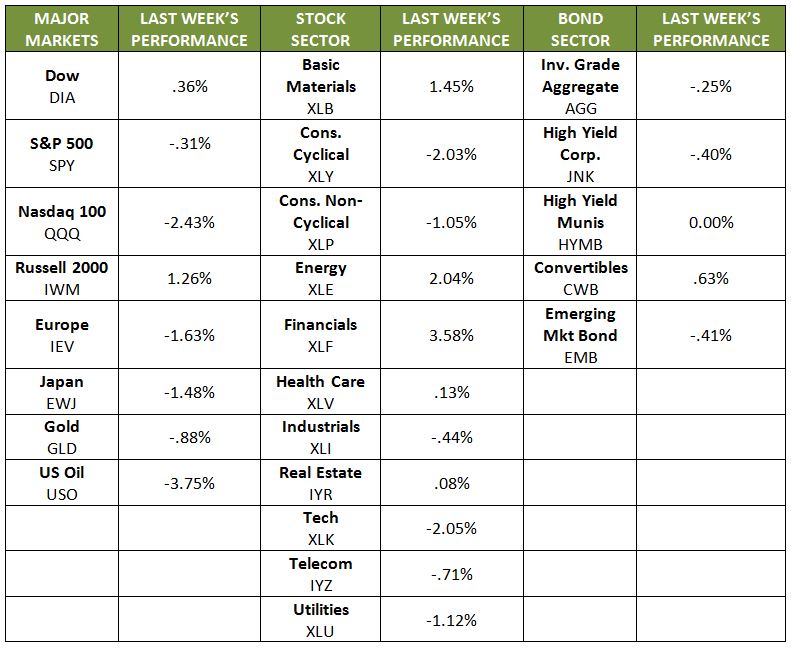

Markets last week were mixed with leading tech stocks falling dramatically as some investors pulled profits. The NASDAQ took the biggest hit, finishing 1.55% down on the week—its worst week of the year. Meanwhile, the Dow rose 0.31% for the week, notching another record close on Friday. The S&P 500 fell 0.30%, and the MSCI EAFE closed the week down 1.22%.

The S&P tech sector dropped 3.3% on Friday; however, it remained up 18% for the year. Major tech stocks account for almost 13% of the total number of stocks in the S&P 500, while comprising nearly 40% of the S&P 500 increase for the year.

Internationally, Asian markets were mixed while European markets closed the week generally higher. The European equities markets took last week’s UK election in stride, though the pound dropped in response to the Conservatives losing their majority.

Domestically, monthly job openings exceeded 6 million in April. Hiring, however, has slowed to only 5 million per month, suggesting workers’ skills may not match job needs. Moreover, the economy continues to show signs of softening.

Indications of a Softer Economy

- Wholesale and Retail Inventories Down: Revised wholesale inventories shrunk 0.5% in April, the largest contraction in more than 12 months. In addition, retail inventories fell in April as sales weakened.

- Inflation Slows: Last week, consumer prices remained weak. Inflation slowed in April to an annual rate increase of 1.7% year-over-year, down from the 1.9% recorded in March and 2.1% in February. Falling oil prices, excessive auto inventories, and increasing apartment rental inventories will all create headwinds to reaching the Fed’s target rate of 2.0%.

- Factory Orders Down: Factory orders fell 0.2% in April. While motor vehicles rose 0.6% and computers gained 1.6%, durable goods orders fell 0.8%.

- Oil Prices Drop: Though summer driving season is here, U.S. gasoline demand dropped by nearly a half-million barrels a day. While the need for fuel fell—and despite beliefs that oil would fall by 3.5 million barrels—stockpiles rose by 3.3 million barrels. As a result, oil dropped by 4%, ending the week at $45.86 per barrel.

What Comes Next?

The Fed will hold a meeting this week to determine whether to raise interest rates. Expectations are that the Federal Open Market Committee (FOMC) will raise the fed funds rate 0.25% to 1.25% despite the soft economic news, which the Fed characterized as “transitory.” The FOMC meeting will also address quarterly forecasts for the remainder of the year. The markets expect both Japan and Britain’s central banks to also address the issue of interest rates.

In addressing the federal debt, the Treasury Secretary assured last week that the U.S. will not default on its debt. Congress must address the debt limit this summer or fall, but markets may react negatively if delays occur. Meanwhile, Congress continues to wrestle with policy questions around tax reform, an infrastructure program, and healthcare reform. How the government addresses these important initiatives could alter market dynamics in the future.

If you have questions on where you stand as these events unfold, do not hesitate to contact us.

ECONOMIC CALENDAR

Wednesday: Consumer Price Index, Retail Sales, Business Inventories, FOMC Meeting Announcement

Thursday: Industrial Production, Housing Market Index

Friday: Housing Starts, Consumer Sentiment