The Weekly Update

Week of September 8th, 2025

By Christopher T. Much, CFP®, AIF®

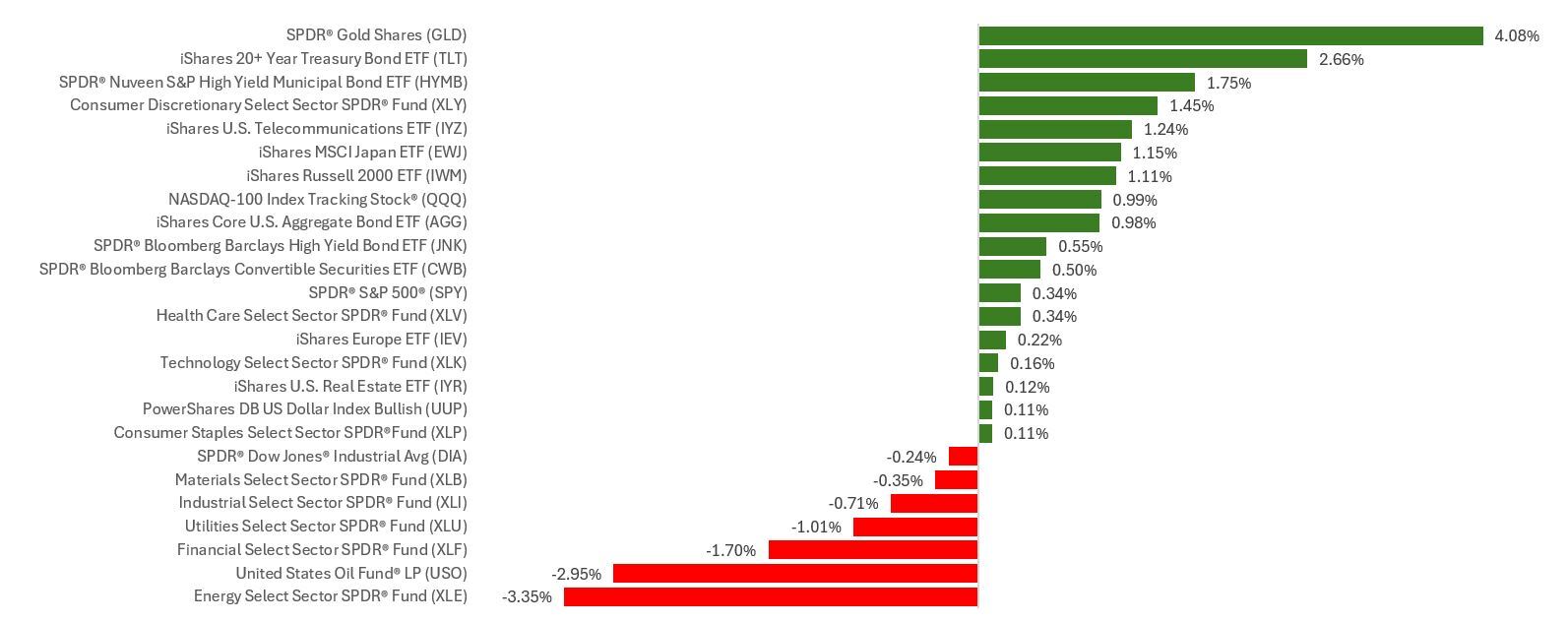

Stocks made gains last week, even as megacap tech gains outweighed economic concerns.

The Standard & Poor’s 500 Index advanced 0.33 percent, while the Nasdaq Composite Index rose 1.14 percent. The Dow Jones Industrial Average descended 0.32 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 0.04 percent.

Tech Gains, Jobs Slow

Markets started the week on shaky ground. The Dow Industrials, S&P 500, and Nasdaq each slipped downward more than half a percentage point. Tariff uncertainty rose again, as a court ruling injected fresh doubt. Meanwhile, rising Treasury yields amplified volatility and rattled megacap tech names.

By Tuesday, stocks managed a partial rebound, and market direction shifted. Tech bounced back the next morning—led by two megacap tech stocks’ gains—with one soaring after avoiding an antitrust penalty.

On Thursday, softer private hiring data and rising layoff trends fueled hopes of an imminent Fed rate move, with the S&P hitting a fresh record close. Treasury yields dropped significantly on rate-cut speculation, reinforcing risk appetite. The mood shifted again on Friday. A surprisingly weak jobs report undercut market optimism.

Focus on Jobs

Friday’s employment report fell short, as employers created fewer jobs last month.

Unemployment increased to 4.3 percent in August from 4.2 percent the prior month, hitting a 4-year high. Job growth slowed to 22,000 jobs in August, after much higher expectations of 75,000. In addition, a revision of the June estimate decreased the number by 27,000 jobs.

This Week: Key Economic Data

Monday: Consumer Credit.

Tuesday: NFIB Small Business Optimism Index.

Wednesday: Producer Price Index (PPI). Wholesale Inventories.

Thursday: Consumer Price Index (CPI). Weekly Jobless Claims. Federal Budget.

Friday: Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; September 5, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Oracle Corporation (ORCL)

Thursday: Adobe Inc. (ADBE)

Source: Zacks, September 5, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.