The Weekly Update

Week of May 3rd, 2021

By Christopher T. Much, CFP®, AIF®

Stocks meandered around a flatline in a busy week of corporate earnings, ending the trading week slightly lower.

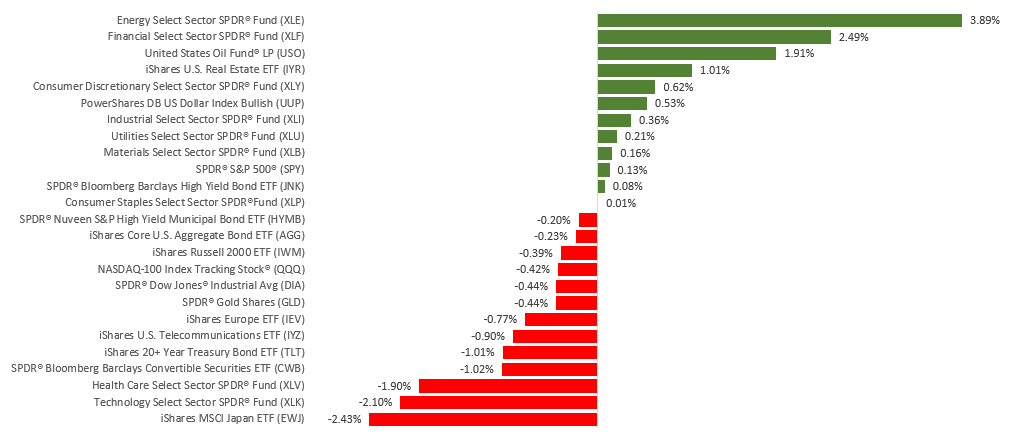

The Dow Jones Industrial Average slid 0.50%, while the Standard & Poor’s 500 was flat (+0.02%). The Nasdaq Composite index surrendered 0.39%. The MSCI EAFE index, which tracks developed overseas stock markets, rose 0.18%.

Seeking Direction

Though the S&P 500 and Nasdaq established new record highs at the start of the week, stocks struggled to find traction as the week wore on.

Investor sentiment was dampened by rising COVID-19 infections in India and Japan, along with mounting inflation worries. Stocks finally caught some lift from strong quarterly reports issued by two big technology companies and an upbeat first-quarter Gross Domestic Product growth number, sending the S&P 500 to a fresh record high.

Once again, though, stocks failed to follow through, as the market retreated in the final day of trading to close near where it began the week.

Earnings Top Expectations

Last week was the biggest week of the first quarter’s earnings season with a third of S&P 500 companies reporting, including six of the largest companies.

With expectations high, businesses generally topped Wall Street analysts’ estimates; Big Tech companies posted especially noteworthy earnings. Coming into last Friday, with 40% of S&P 500 index companies reporting, earnings-per-share growth (EPS) is now estimated to be 29.3%, well ahead of the 12.2% EPS growth rate that analysts had expected at the start of the year.

This Week: Key Economic Data

Tuesday: Factory Orders.

Wednesday: ADP (Automated Data Processing) Employment Report. ISM (Institute for Supply Management) Services Index.

Thursday: Jobless Claims.

Friday: Employment Situation Report.

Source: Econoday, April 30, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: CVS Health Corporation (CVS), Pfizer, Inc. (PFE), Dominion Energy (D), Prudential Financial (PRU).

Wednesday: Paypal Holdings (PYPL), General Motors (GM), Twilio, Inc. (TWLO), Etsy, Inc. (ETSY), Cognizant Technologies (CTSH).

Thursday: Square, Inc. (SQ), Roku, Inc. (ROKU), Albemarle Corporation (ALB), Regeneron Pharmaceuticals, Inc. (REGN), Booking Holdings (BKNG), Expedia Group (EXPE), Kellogg Company (K).

Friday: Berkshire Hathaway (BRK.A), EOG Resources (EOG), Cigna Corporation (CI), Draftkings, Inc. (DKNG).

Source: Zacks, April 30, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.