The Weekly Update

Week of January, 7 2019

By Christopher T. Much, CFP®, AIF®

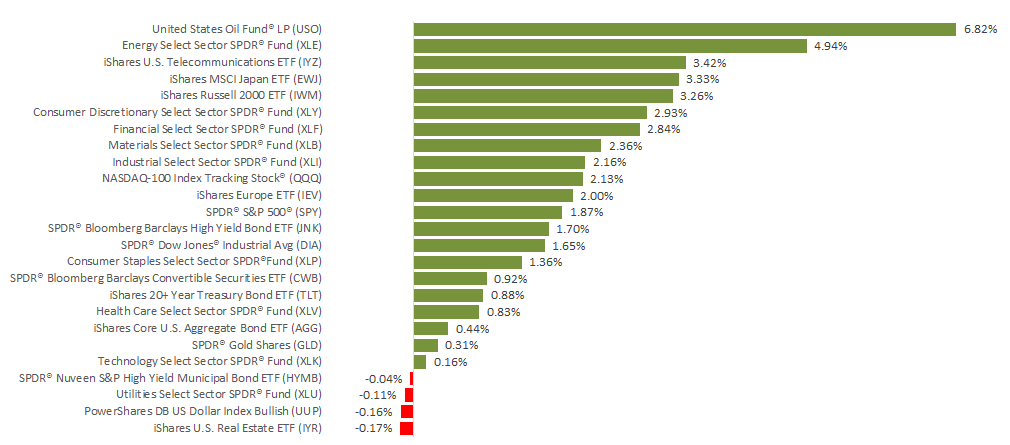

U.S. markets experienced more wild sessions last week before ending in positive territory as the recent turbulence continued. In fact, we are currently in the middle of some of the most volatile market performance in more than eight years. For the week, the S&P 500 gained 1.86%, the Dow added 1.61%, and the NASDAQ increased 2.34%. MSCI EAFE stocks also increased, posting a 1.42% weekly gain.

While the results may not seem especially dramatic, the path to get there certainly was. On Thursday, January 3, domestic stocks plunged, as factory data and a tech warning spooked investors. Then, the next day, the S&P 500, Dow, and NASDAQ each gained at least 3.3%. Friday’s performance marked one of the largest rallies since the beginning of this bull market.

What drove the market rally?

Two key events contributed to the huge jumps on Friday: 1) the latest labor report and 2) comments from the Federal Reserve Chairman.

1. December’s labor report exceeded projections.

Many people expected that the economy would add around 176,000 jobs last month. Instead, the latest data revealed that the increase was actually 312,000 new jobs in December—drastically beating expectations. Not only did last month’s labor report show more jobs added than anticipated, but wage growth and labor market participation also increased.

Why does this data matter?

Investors have been very concerned that economic growth is slowing. This data helped quell worries that a recession is ahead.

2. The Fed shared new policy perspectives.

Fed Chair Jerome Powell told the American Economic Association that the Federal Reserve understands the market’s worries and hasn’t predetermined its future interest rate hikes.

Why does this update matter?

Some of the uneasiness the markets have shown recently are a result of concerns that the Fed is tightening monetary policy too quickly. Powell’s comments indicate the Fed is sensitive to economic conditions, an update that many investors wanted to hear.

What is on the horizon?

A number of unresolved situations remain for the markets and economy. The government shutdown continues, and a solution doesn’t appear imminent at the moment. Trade dynamics are also still an important consideration, especially since corporations are now issuing warnings that trade is affecting their profits. Meanwhile, U.S. officials will be meeting with China this week to talk once again.

For now, the volatility we are experiencing may continue. Remember, we’re closely tracking developments to see how they may affect your financial life. If you have questions about how to weather these ups and downs, we are here for you.

ECONOMIC CALENDAR:

Monday: Factory Orders, ISM Non-Mfg. Index

Tuesday: JOLTS

Wednesday: FOMC Minutes

Thursday: Jobless Claims

Friday: CPI