The Weekly Update

Week of September 3, 2018

By Christopher T. Much, CFP®, AIF®

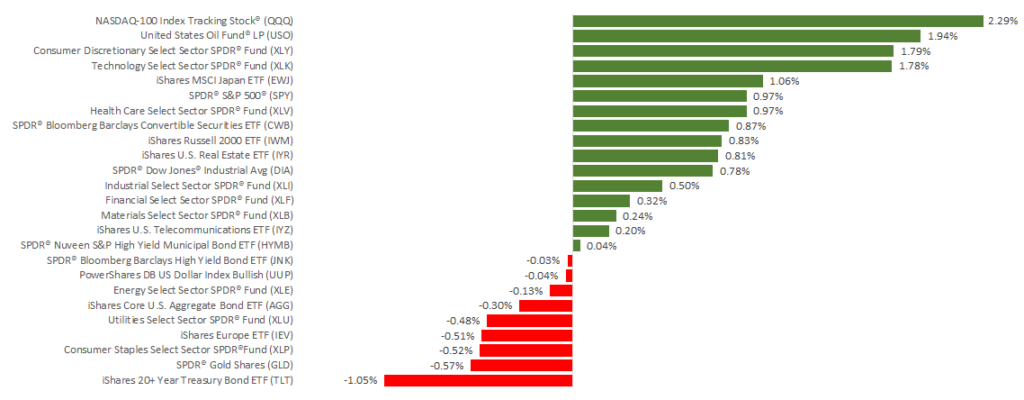

Trade continued to dominate the news last week and cause market volatility as investors monitored discussions of the North American Free Trade Agreement (NAFTA) and tension with China. While Mexico and the U.S. reached a new trade deal early in the week, talks with Canada stalled on Friday, August 31. Reports also came out that President Trump may be adding tariffs on another $200 billion in Chinese goods. Domestic markets increased for the week and ended August in positive territory. The S&P 500 and Dow each had their best August since 2014—while the NASDAQ’s 5.7% growth was its best performance for the month since 2000. On Wednesday, the S&P 500 reached a new record high. For the week, the S&P 500 gained 0.93%, the Dow added 0.68%, and the NASDAQ increased 2.06%. International stocks in the MSCI EAFE joined the growth, adding 0.26%.

Key Data from Last Week

Although trade might have dominated headlines, last week provided several informative economic updates, including:

- Personal incomes grew in July.

The 0.3% increase fell slightly short of the projected growth but is still up 4.7% since this time last year. Combined with growth in personal consumption, this data indicates that consumers had a solid start to the 3rd quarter of 2018. - Gross Domestic Product (GDP) was higher than initially thought.

The 2nd reading of GDP expansion between April and June was 4.2%, higher than the initial reading and still the fastest economic expansion since 2014. Economists don’t believe this pace is sustainable, however, as rising interest rates, ongoing trade tension, and fading tax-cut benefits could slow growth later in the year. - Consumer confidence soared in August.

The latest consumer confidence data came in higher than it has since October 2000. This strong reading may indicate that consumer spending will remain healthy for now. Since consumer spending is more than ⅔ of the U.S. economy, its growth is a critical factor to track.

This week’s performance and reports once again underscore a message we have frequently shared with you: Instead of focusing on the headlines, pay attention to the fundamentals for a clearer understanding of the economy. If you have questions about how this data affects your financial life, we’re here to talk.

ECONOMIC CALENDAR:

Monday: U.S. Markets Closed for Labor Day Holiday

Tuesday: PMI Manufacturing Index, ISM Mfg Index, Construction Spending

Wednesday: Motor Vehicle Sales, International Trade

Thursday: ADP Employment Report, Factory Orders, ISM Non-Mfg Index, Jobless Claims

Friday: Employment Situation