The Weekly Update

Week of July 10, 2017

By Christopher T. Much, CFP®, AIF®

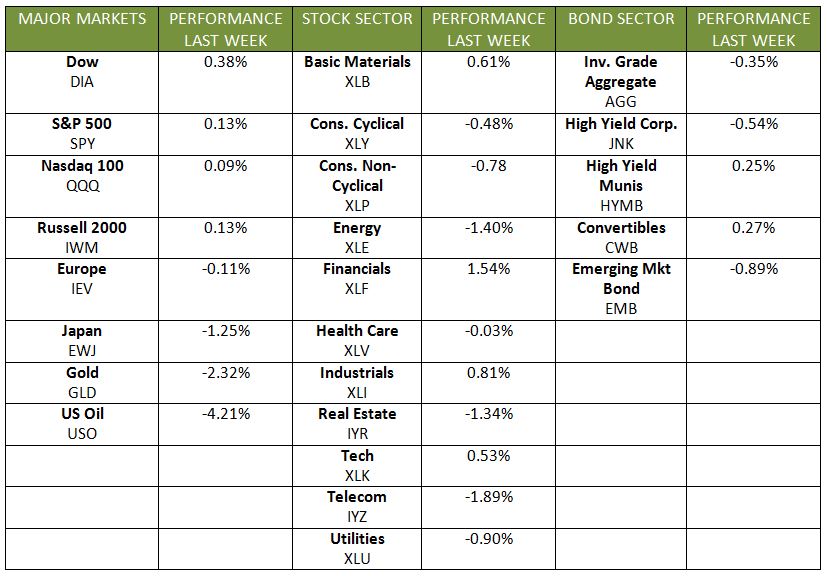

As the country celebrated the Fourth of July last week, the markets experienced some volatility, though they finished a bit flat overall. The Dow fell then rose to close the week up 0.30%. The S&P 500 climbed a modest 0.07% for the week, and the NASDAQ finished the week up 0.21%. The MSCI EAFE fell 0.48%.

Internationally, European markets posted soft gains on Friday, though emerging markets fell for a second-straight week. Further, gold dropped to a 5-month low, while bond yields rose globally on weakening bond markets. In addition, world leaders met last week at the G20 Global Summit and issued a statement supporting open markets. They agreed to fight unfair trade practices, such as countries blocking or heavily taxing imports to protect domestic industries.

A Closer Look at U.S. Market News

- Auto Sales Continue to Drop: Auto sales dropped in June by 3% from a year ago. Though vehicle sales are still generally high, numbers in the second half of 2017 are expected to remain soft.

- Employment Numbers Give Mixed Signals: Payroll growth rose a strong 222,000, exceeding expectations of 170,000. The employment growth numbers, along with continuing low unemployment figures, reflect a high demand for workers. However, wage growth remains low at an annual rate of 2.5%.

- Inflation Stays Weak: Inflation came in at a weak 1.4% in May, staying well below the Fed’s target of 2.0%. Despite weak inflation numbers, the Fed appears committed to raise interest rates one more time this year.

- Manufacturing Rises and Falls: The PMI manufacturing index closed at a low 52.0, down from May’s 52.7 on weak cost pressures and selling prices. Meanwhile, some good news emerged: The ISM manufacturing index surprised expectations of 55.1 and rose to 57.8—the strongest number since August 2014.

- Oil Prices Continue to Slump: Oil dropped to $44.33 per barrel on continuing oversupply concerns. The week’s price erosion comes after a 14% drop in the first half of 2017.

A Look Ahead

On Friday, July 14, key economic data will emerge such as consumer price index, retail sales, and consumer sentiment. As we look to the second half of 2017, a variety of developments could boost markets: strong corporate earnings, strengthening wage rates, and growing global trade and Gross Domestic Products (GDPs).

We want to remind you to avoid letting geopolitical ups and downs sway your investment focus. Instead, stay tuned to the fundamentals as you work toward your long-term goals. Feel free to contact us for any perspectives that can help you make sense of your financial life.

ECONOMIC CALENDAR

Tuesday: Job Openings and Labor Turnover Survey (JOLTS)

Wednesday: Beige Book

Thursday: Jobless Claims

Friday: Consumer Price Index, Retail Sales, Industrial Production, Business Inventories, Consumer Sentiment