The Weekly Update

Week of February 5, 2018

By Christopher T. Much, CFP®, AIF®

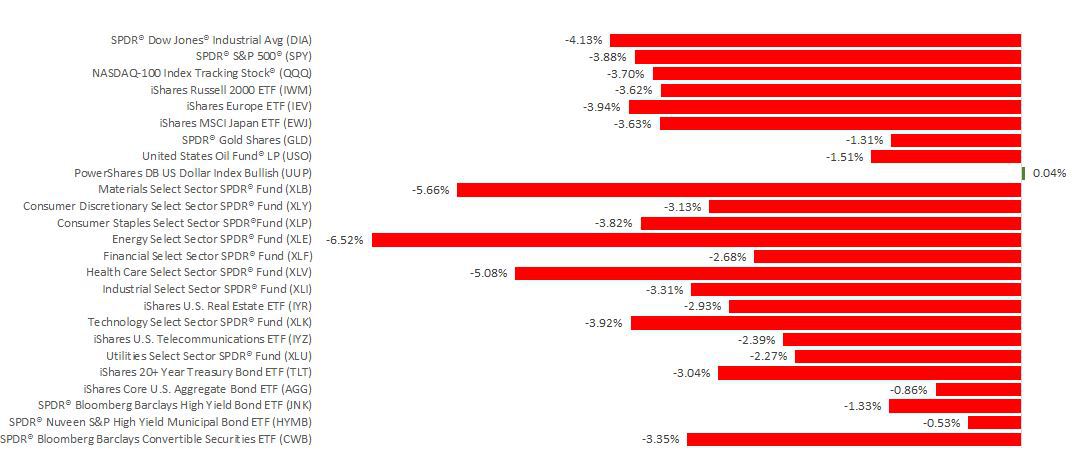

After 4 straight weeks of gains, the markets have slipped. As of Friday, the S&P 500 lost 3.85%, the Dow dropped 4.12%, and the NASDAQ decreased by 3.53%. International stocks in the MSCI EAFE also took a 2.78% hit. Domestically, the losses spanned sectors and asset classes. For the S&P 500, all 11 of the index’s industries lost ground last week. This decline came after the S&P 500 had its best January performance in over 20 years.

So, what happened?

Looking at the markets’ sizable losses, you might expect that discouraging economic data came out last week—or some geopolitical drama spooked investors. On the contrary, the drops came in response to news that seems positive on the surface: Job and wage growth are picking up.

Reviewing the Jobs Report

On Friday, the Bureau of Labor Statistics reported that we added 200,000 new jobs in January and beat expectations. Average hourly wages also increased, bringing 2.9% growth in the past 12 months—the largest rise since 2008–2009.

Analyzing the Reaction

When labor data came out, bond yields jumped and 10-year Treasury yields hit their highest level in 4 years. Stocks sank in reaction to these interest rate gains.

Concerns about inflation are fueling this reaction. As wages grow, companies may increase their prices to support their rising labor costs—contributing to an inflationary cycle. With inflation can come rising interest rates.

Because of this news, some investors became concerned that the Federal Reserve may increase interest rates this year more than initially expected.

Putting the Performance in Perspective

After the unusually calm market environment we experienced in 2017, last week’s declines may feel unsettling. However, price fluctuations are normal, and the economy continues to be strong.

In addition, as domestic indexes reach high levels, viewing their declines in terms of points, rather than percentages, can cause unnecessary concern. You may have read reports that the Dow dropped 665.75 points on Friday, contributing to its 6th biggest points decline in history. But even after losing nearly 1100 points in 5 days, the Dow was only down 4.12% for the week and remained up 3.24% for the year. Of course, every economic environment has risks, and no market can go up forever. We are aware of the risks that increasing inflation and interest rates may bring, and we are here to help you navigate what the future holds.

ECONOMIC CALENDAR:

Monday: ISM Non-Mfg Index

Tuesday: International Trade

Wednesday: EIA Petroleum Status Report

Thursday: Jobless Claims