The Weekly Update

Week of August 4th, 2025

By Christopher T. Much, CFP®, AIF®

Stocks fell last week as investors assessed progress on trade negotiations, new U.S. tariffs, and fresh data on the U.S. economy.

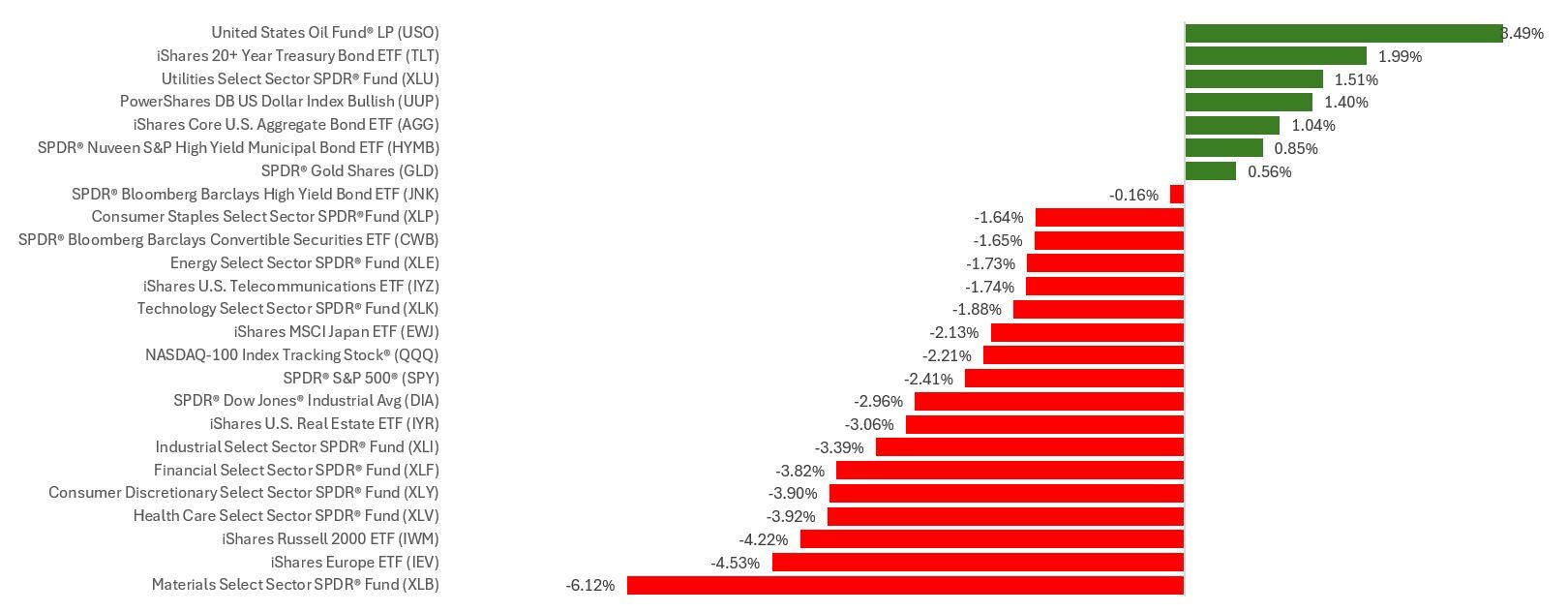

The Standard & Poor’s 500 Index fell 2.36 percent, while the Nasdaq Composite Index declined 2.17 percent. The Dow Jones Industrial Average dropped 2.92 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, lost 2.95 percent.

Action-Packed Week

Stocks largely went sideways over the first half of the week as investors waited for more Q2 corporate results, fresh economic data, and the Fed decision.

The U.S.-E.U. trade agreement announced over the weekend had a muted impact on the market as the week began. Stocks then retreated as China trade talks appeared to stall, with the Dow declining the most of the three major averages through midweek.

Stocks gained on Wednesday morning after the latest gross domestic product (GDP) report showed consumer spending powered the economy back to 3 percent annualized growth in Q2. That afternoon, the Federal Reserve announced they were holding rates steady, which put some pressure on stocks.

Selling pressure continued on July’s final trading day as investors continued to fret about the Fed’s next move. The Personal Consumption and Expenditures (PCE) Index—the Fed’s favored inflation metric—showed a June uptick in core goods prices, unsettling investors.

Stocks were under pressure from the opening bell on Friday as investors sorted through fresh tariff announcements from the White House, a softer-than-expected July jobs report, and mixed Q2 corporate reports from two megacap tech names.

Mixed Economic Signals

There was a trove of economic data for investors to parse last week.

First, there was economic growth. While 3 percent GDP growth in Q2 is a solid step up from a 0.5 percent contraction in Q1, consumer spending largely drove the increase, offset by slower business spending—especially investment in equipment and buildings.

The PCE report showed why the Fed remains focused on inflation. Finally, Friday’s jobs report pointed to a slowdown in hiring in July. A bit more concerning was that the jobs data from prior months were revised lower.

The Fed has no meeting in August, with three other meetings scheduled for 2025.

This Week: Key Economic Data

Monday: Factory Orders. Motor Vehicles Sales.

Tuesday: Trade Deficit. ISM Services Index.

Wednesday: Treasury Buyback Announcement. 10-Year Treasury Note Auction. San Francisco Fed President Mary Daly speaks.

Thursday: Productivity and Costs. Weekly Jobless Claims. Wholesale Inventories. Consumer Credit. Fed Balance Sheet. Atlanta Fed President Raphael Bostic speaks.

Friday: St. Louis Fed President Alberto Musalem speaks.

Source: Investor’s Business Daily – Econoday economic calendar; August 1, 2025.

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Palantir Technologies Inc. (PLTR), Vertex Pharmaceuticals Incorporated (VRTX)

Tuesday: Advanced Micro Devices, Inc. (AMD), Caterpillar Inc. (CAT), Amgen Inc. (AMGN), Arista Networks, Inc. (ANET), Pfizer Inc. (PFE), Duke Energy Corporation (DUK)

Wednesday: McDonald’s Corporation (MCD), The Walt Disney Company (DIS), Uber Technologies, Inc. (UBER), Shopify Inc. (SHOP), AppLovin Corporation (APP), DoorDash Inc. (DASH), Brookfield Asset Management Ltd. (BAM)

Thursday: Eli Lilly and Company (LLY), Gilead Sciences, Inc. (GILD), ConocoPhillips (COP), Constellation Energy Corporation (CEG)

Source: Zacks, August 1, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.