The Weekly Update

Week of December 3, 2018

By Christopher T. Much, CFP®, AIF®

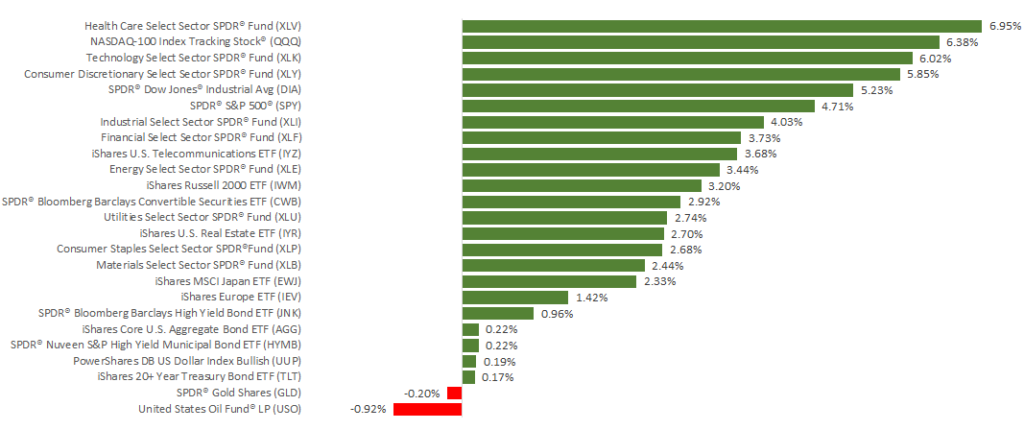

U.S. markets ended a volatile month on a high note Friday. All three major indices posted impressive increases for the week, buoyed by news from the Fed Reserve and international trade. The S&P 500 jumped 4.85%, and the NASDAQ finished up 5.64%—both gains are almost 7-year highs. Meanwhile, the Dow experienced a 2-year high, increasing 5.16%. Internationally, the MSCI EAFE rose 0.95%.

To better understand last week’s sharp rebound, let’s take a closer look at details surrounding comments by Fed Chairman Jerome Powell and various international developments.

Fed Developments

Last Wednesday, Powell inspired optimism in investors by claiming that interest rates are close to the current neutral range of 2.5–3.5%. His comments seemed to suggest that the Fed may throttle back interest rate hikes. However, minutes released on Thursday from the central bank’s meeting contained no indication that the Fed had changed its policy. Therefore, we can only assume the Fed still plans on a fourth rate hike in 2018, and increases may continue during 2019, but we need to wait for more clarity from the Fed.

The G20 Summit

At the annual G20 summit, leaders from the world’s 19 biggest economies and the European Union assembled in Buenos Aires. This group represents 85% of the world’s economic output and 2/3 of its population. Here are a few key takeaways from the summit:

- United States–Mexico–Canada Agreement

On November 30, President Trump met with Canadian Prime Minister Justin Trudeau and Mexican President Enrique Peña Nieto. They signed the anticipated United States¬–Mexico–Canada Agreement (USMCA) to replace NAFTA. With the recent U.S. tariffs on Canadian steel and aluminum causing tension, the USMCA may start to ease the strain, although some remain skeptical. Plus, the agreement still needs to pass Congress. Its true outcome is still unknown. - Trade Talks with China

President Trump and China’s President Xi met on December 1 to attempt resolving trade issues between the two countries. Since last July, the U.S. has hit Chinese goods with a total of $250 billion in tariffs and has threatened more. In turn, China retaliated by imposing $110 billion in tariffs on U.S. products. Ultimately, both countries agreed to delay any increases in tariffs for 90 days, while they attempt to iron out remaining disputes. If they cannot reach an agreement, President Trump says he will raise rates from 10% to 25%. - Other G20 Concerns

Low oil prices and oversupply continue to worry investors. The leaders from two of the three largest oil-producing countries, Russia and Saudi Arabia, met to discuss reducing production and raising prices. In addition to trade issues and oil, G20 leaders are grappling with different views on climate change and the new spat between Russia and the Ukraine.

Stay Focused

While the Fed and geopolitical issues dominate the news cycle, we’re here to remind you to keep market fundamentals in mind. As a whole, the economy looks strong through 2018. For example, last week we learned:

- Consumer confidence remains high, though it fell slightly in November. This dip follows an 18-year sustained peak in positive territory.

- Q3 Gross Domestic Product increased a solid 3.5%. Business investments performed better than expected, with corporate profits boosting to a new 6-year high.

- Unemployment lowered to 3.7%, the lowest it has been in at least 48 years.

As always, we remain dedicated to helping you navigate your financial life amidst economic and geopolitical news. If you have questions about how this information may affect your portfolio, contact us today.

ECONOMIC CALENDAR:

Monday: PMI Manufacturing Index

Wednesday: ISM Non-Manufacturing Index

Thursday: Factory Orders