The Weekly Update

Week of May 26th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Upbeat comments by the Federal Reserve Chairman and more signs of an economic turnaround combined to help fuel a powerful rally in the stock market last week.

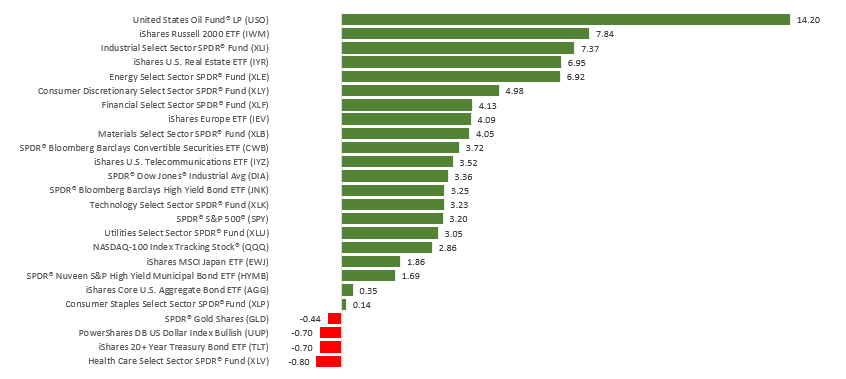

The Dow Jones Industrial Average rose 3.29%, while the Standard & Poor’s 500 advanced 3.20%. The Nasdaq Composite index climbed 3.44% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 3.87%.

Stocks Cheer Fed Support

The markets surged higher to open the week, buoyed by a Sunday night “60 Minutes” interview with Fed Chair Jerome Powell, who said that the Federal Reserve would do everything necessary to support economic recovery. Rising oil prices and more states lifting restrictions added to the overall improving investor outlook.

After a day digesting those gains, stocks moved another leg higher on strong earnings from big retailers and growing optimism over the global economic recovery. Stocks drifted in the final two days of trading as investors worried about heightening tensions between the U.S. and China.

Different Views on the Economic Recovery

Treasury Secretary Steven Mnuchin and Fed Chair Powell testified last week before the Senate Banking Committee, providing Senators with two different views of the nation’s economic outlook.

Secretary Mnuchin suggested a wait-and-see approach before moving ahead with additional fiscal measures. He wants to pause new spending in order to first assess the impact of the already-approved stimulus program. He believes that the economy will experience a “V-shaped” recovery.

Fed Chair Powell, on the other hand, expressed worries that waiting too long for additional fiscal measures may hamper the fragile economic recovery. It was the third time in a week that the Fed Chair suggested more federal spending is needed to help the economic recovery.

Final Thoughts

One of the challenges of assessing the U.S. economy using certain government reports, like the consumer price index or the employment report, is that they are considered “lag indicators.” Lag indicators provide good insight into where we’ve been but are less helpful in looking at the current state of economic activity.

Looking at some “real-time” data can help investors better assess the here-and-now. For example, gasoline deliveries are trending higher, consumer confidence appears to have stabilized, and airlines are seeing more bookings. Even the supply of toilet paper seems less of a concern these days, with Google searches falling to near normal levels.

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Consumer Confidence. New Home Sales.

Thursday: Jobless Claims. Durable Goods Orders. Gross Domestic Product (GDP).

Source: Econoday, May 22, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: Autozone (AZO)

Wednesday: HP (HPQ), Workday (WDAY), Autodesk (ADSK)

Thursday: Salesforce.com (CRM), Costco (COST), Trip.com (TCOM), Okta (OKTA), Dollar General (DG), Dell Technologies (DELL), VMware (VMW)

Source: Zacks, May 22, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.