The Weekly Update

Week of April 27th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stock prices bounced around last week as investors reacted to wild swings in the price of oil and reports that called into question the efficacy of two potential virus treatments.

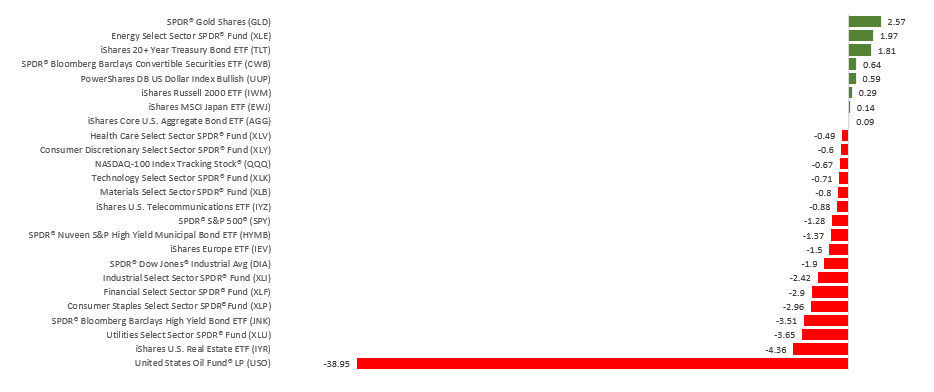

The Dow Jones Industrial Average retreated 1.93%, while the Standard & Poor’s 500 lost 1.32%. The Nasdaq Composite Index slipped 0.18%. The MSCI EAFE Index, which tracks developed overseas stock markets, declined 1.21%.

Oil Wavers, Promising Virus Treatments Disappoint

Stocks opened the new week lower on the heels of a plunge in oil prices that saw the May oil futures contract fall into negative territory. While negative prices were largely reflective of technical issues associated with trading the contracts rather than the actual price of oil, the unprecedented move unsettled investors.

Stocks found some positive momentum as the week wore on, buoyed by corporate earnings reports that showed solid performance amid a challenging environment.

On two separate days, however, solid moves to the upside were derailed by disappointing news on promising COVID-19 treatments. One drug failed to produce positive results in its first trial, followed the next day by an FDA warning against taking chloroquine and hydroxychloroquine to treat COVID-19. Stocks managed to rally and trim the week’s losses during the market’s final hours on Friday.

The Economic Reopening Begins

States across the nation, including Georgia, Tennessee, South Carolina, and Texas, have begun the process of slowly reopening commerce, while Montana’s governor announced the first phase of restarting its economy.

Each state is taking a different approach, potentially serving as a laboratory to help guide other states in their efforts to reopen businesses. From the market’s perspective, these early steps are not only hopeful signs that the journey to normalization may have begun, but they may provide important clues to how quickly business activity can rebound and the degree to which individuals resume social engagement – two important metrics that may influence the market in the weeks ahead.

THIS WEEK: KEY ECONOMIC DATA

Wednesday: Gross Domestic Product (GDP). Federal Open Market Committee (FOMC) Meeting Announcement.

Thursday: Jobless Claims.

Friday: Purchasing Managers Index (PMI): Manufacturing Index. Institute for Supply Management (ISM) Manufacturing Index.

Source: Econoday, April 24, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: Advanced Micro Devices (AMD), Ford Motor Company (F), Pfizer (PFE), Caterpillar (CAT), Starbucks (SBUX), Merck & Co. (MRK), United Parcel Service (UPS), D.R. Horton (DHI)

Wednesday: Microsoft (MSFT), Facebook (FB), Boeing (BA), Tesla (TSLA), Qualcomm (QCOM)

Thursday: Apple (AAPL), Amazon (AMZN), Visa (V), McDonald’s (MCD), Gilead Sciences (GILD)

Friday: Exxon Mobil (XOM), Chevron (CVX), Clorox (CLX), Abbvie (ABBV)

Source: Zacks, April 24, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.