The Weekly Update

Week of April 13th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

The stock market staged a broad rally this week, buoyed by the prospect that COVID-19’s grip on the nation may be easing and news of another Federal Reserve program to help stabilize businesses.

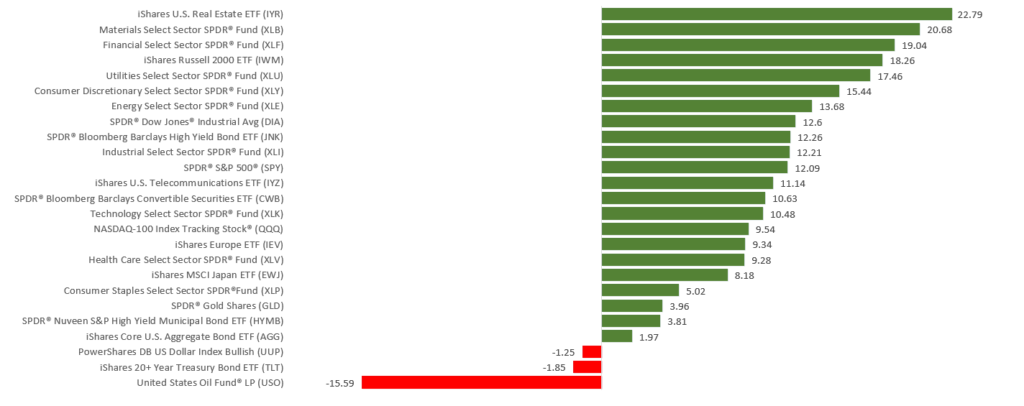

The Dow Jones Industrial Average jumped 12.67%, while the Standard & Poor’s 500 climbed 12.10%. The Nasdaq Composite Index rose 10.59% for the week. The MSCI EAFE Index, which tracks developed overseas stock markets, advanced 6.32%.

A Change in Sentiment

Market sentiment took a more hopeful turn on news of an apparent peaking of cases in Italy and New York State. Investors also welcomed comments by Dr. Anthony Fauci that the start of a turnaround in the outbreak is close at hand.

The S&P 500 Index surged 7.03% to start the week and added to gains as the week progressed. Positive trends in COVID-19 cases, an agreement between Russia and Saudi Arabia to cut oil production, and the Fed’s unveiling of a $2.5 trillion loan program to assist small and midsize businesses fueled the rally.

Credit Markets Stabilize

As the economy shut down in March, credit markets began to exhibit deep stresses. A functional bond market is essential to economic and financial health, which is why the Federal Reserve initiated a number of actions aimed at helping them to operate.

Intervention by the Fed appears to have helped. A raft of new bond offerings may be signaling that investors are now willing to take on more risk. Last week, 11 investment-grade companies sold nearly $20 billion in bonds.

A stable credit market helps the stock market, and while the bond market is not yet out of the woods, its improving health is a positive sign.

Final Thought

One of the major challenges for investors in the last month has been determining realistic stock valuations amid uncertainty over corporate earnings. With earnings season about to unfold, investors may be able to better gauge the impact of the pandemic on company profits. Investors will get to hear from corporate leaders about the state of their businesses and possibly their outlook for the next few quarters. This may help fill in the gap that currently exists but what remains uncertain is whether that information proves to be positive or negative for the market.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: Retail Sales. Industrial Production.

Thursday: Housing Starts. Jobless Claims.

Friday: Index of Leading Economic Indicators.

Source: Econoday, April 9, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Johnson and Johnson (JNJ), JP Morgan Chase (JPM), Wells Fargo (WFC)

Wednesday: Bank of America (BAC), UnitedHealth Group (UNH), Citigroup (C), Goldman Sachs (GS)

Thursday: Blackstone Group (BX), Taiwan Semiconductor (TSM), Abbott Laboratories (ABT)

Friday: Schlumberger (SLB), Kansas City Southern (KSU)

Source: Zacks, April 9, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.