The Weekly Update

Week of April 2, 2018

By Christopher T. Much, CFP®, AIF®

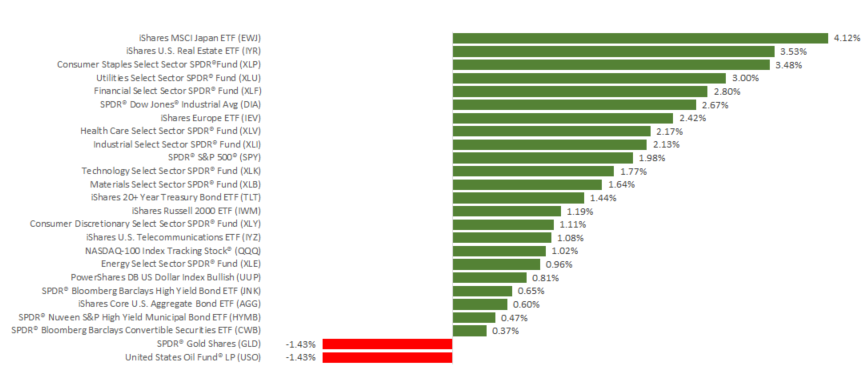

Markets were closed on March 30 for Good Friday, but in the four days of trading, stocks recovered some of this year’s losses. For the week, the S&P 500 added 2.09%, the Dow gained 2.67%, and the NASDAQ increased by 1.03%. International stocks in the MSCI EAFE grew 0.81%.

Last week also marked the end of the year’s 1st quarter. Our next market update will share a recap of key performance details and events from January through March.

In this report, we will consider findings from last week and offer some perspective on the data.

What We Learned Last Week

- The Economy Expanded More Than Thought

We received the final reading of 4th quarter 2017 Gross Domestic Product (GDP), and the numbers were higher than expected. Between October and December last year, GDP grew at a 2.9% annualized rate. In particular, consumer spending contributed significantly to our economic growth. - Consumers Remained Confident

Consumer Sentiment readings reached a 14-year high in March and may be a sign that spending was also on the rise last month. Meanwhile, the Consumer Confidence report showed slightly lower readings than in February but continued to stay high. Though respondents’ confidence in the stock market wavered, their strong assessments of the labor market helped maintain solid numbers. - Personal Incomes Rose

Personal income grew 0.4% in February and has increased 3.7% over the past 12 months. Consumers also spent more money, and data on personal debt and financial obligations indicates that they still have more room to spend.

The Takeaway

Examined together, this data seems to indicate that consumers are confident about the economy and their job prospects—and are continuing to earn and spend more. Considering that approximately 69% of the U.S. economy comes from consumer spending, these developments should be positive news.

That said, every market environment has risks, and no economy is perfect. We are here to help you navigate your finances and make sense of developing news. If you have any questions, contact us any time.

ECONOMIC CALENDAR:

Monday: PMI Manufacturing Index, ISM Mfg Index, Construction Spending

Tuesday: Motor Vehicle Sales

Wednesday: ADP Employment Report, Factory Orders, ISM Non-Mfg Index

Thursday: Jobless Claims

Friday: Employment Situation