The Weekly Update

Week of February 4, 2019

By Christopher T. Much, CFP®, AIF®

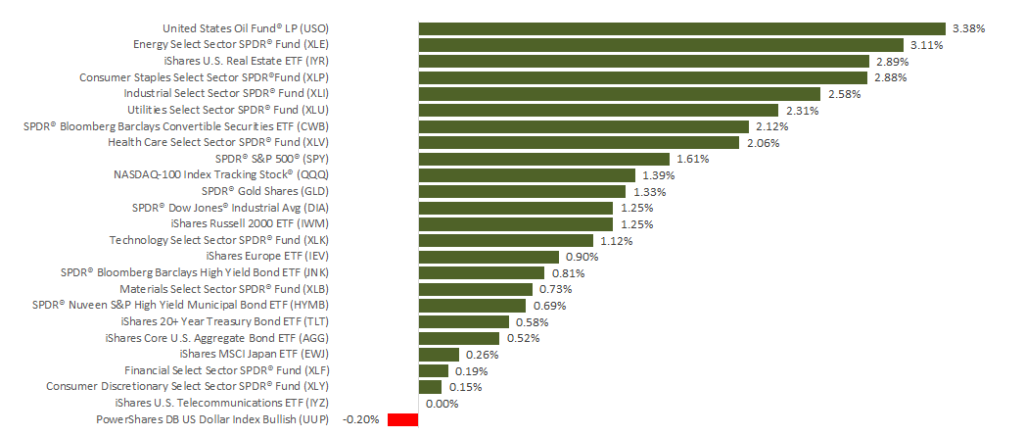

Last week closed out one of stocks’ top January performances in years. In fact, both the S&P 500 and Dow posted their best January results in at least 3 decades. For the week, major domestic indexes were also up. The S&P 500 gained 1.57%, the Dow added 1.32%, and the NASDAQ increased 1.38%. The Dow’s performance marked its 6th week of gains in a row. Internationally, MSCI EAFE stocks also posted growth, rising 0.91%.

What drove stock results last week?

As discussed in our previous market update, last week provided a number of details for investors to focus on. Here are some key items that contributed to market performance:

Federal Reserve Meeting: The Fed chose not to increase interest rates above its current 2.25% – 2.50% target. When releasing this update, the central bank noted that it would be “patient” when deciding about any future increases.

Market Impact?

The Fed’s signal that additional rate hikes may not be imminent helped improve market confidence.

Corporate Earnings: By Friday, nearly half of S&P 500 companies had released earnings data for the 4th quarter of 2018. Of them, 70% had higher earnings-per-share than expected and 62% beat revenue projections. Right now, the S&P 500 is poised to have its 5th quarter in a row of double-digit earnings growth. However, the currently projected growth of 12.4% is lower than it has been since 2017.

Market Impact?

With worries of disappointing results calmed, some investors are feeling relieved by earnings season so far.

January Labor Report: The latest Employment Situation release from the Bureau of Labor Statistics showed that the economy added 304,000 new jobs in January. At the same time, the unemployment rate increased slightly, as the count included furloughed federal workers. The latest data also indicated that December job growth was lower than initially reported.

Market Impact?

The January job growth was much higher than investors expected and implied the partial government shutdown minimally affected the U.S. economy. These perspectives helped drive stock gains on Friday.

This week, we will continue to monitor corporate earnings season and will follow any developments in the U.S.–China trade negotiations. We will also watch for new data releases, especially those previously delayed by the government shutdown. If you have any questions, we’re here for you.

ECONOMIC CALENDAR:*

Monday: Motor Vehicle Sales, Factory Orders

Tuesday: PMI Services Index, ISM Non-Mfg Index

Wednesday: Jerome Powell Speaks

Thursday: Jobless Claims

*The federal government shutdown may delay some data releases.