The Weekly Update

Week of November 21st, 2022

By Christopher T. Much, CFP®, AIF®

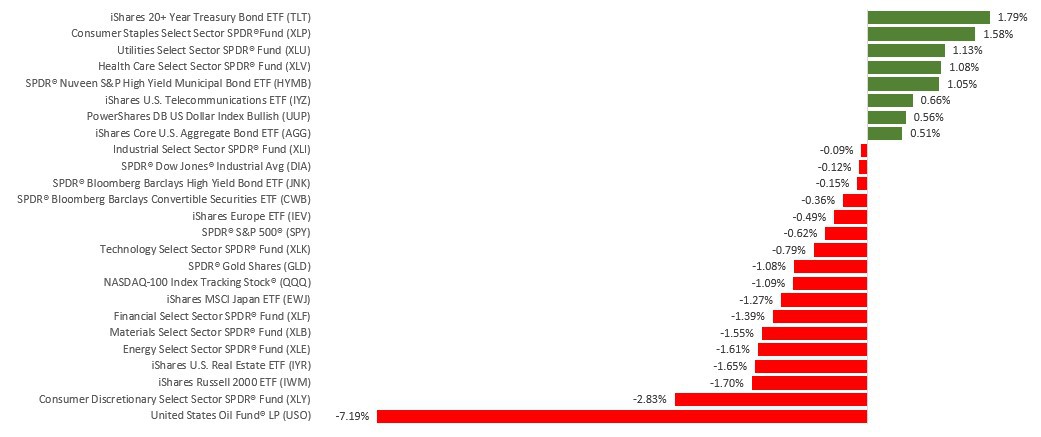

The stock market edged lower last week as it digested a crosscurrent of conflicting economic data and contrasting comments from Fed officials.

The Dow Jones Industrial Average was flat (-0.01%), while the Standard & Poor’s 500 declined by 0.69%. The Nasdaq Composite index lost 1.57% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 0.88%.

Stocks Slip

Stocks took a spill after Fed officials’ comments cast uncertainty about future rate hikes. The more hawkish comments soured investor hopes of an imminent easing in Fed rate hikes, a prospect that had helped fuel the market rally the previous week.

Concerns over the hawkish comments raised investor worries over recession risks, anxiety exacerbated by weak housing data and layoff announcements from major technology companies. The economic picture, however, included some encouraging news as retail sales rose and producer price increases moderated.

Producer Prices Ease

The Producer Price Index (PPI), which reflects the costs paid by domestic producers, seen as an indicator of future consumer prices, is not typically a market-moving event. That was not the case last week.

October’s PPI rose a modest 0.2%, well below the 0.4% consensus estimate. The year-over-year increase moderated to 8.0%, compared to 8.4% in September and the peak of 11.7% in March. The eye-catching element may have been the 0.1% service decline, representing the first decline since November 2020. Excluding food and energy, the PPI was flat for the month and up 6.7% from a year ago.

A Final Word

We wish you and your family a wonderful Thanksgiving and express our gratitude for the privilege of working with you. Happy Thanksgiving!

This Week: Key Economic Data

Wednesday: Durable Goods Orders. Jobless Claims. Purchasing Managers’ Index (PMI) Composite. New Home Sales. Consumer Sentiment. FOMC Minutes.

Source: Econoday, November 18, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Dell Technologies, Inc. (DELL), Zoom Video Communications, Inc. (ZM).

Tuesday: Best Buy Co., Inc. (BBY), Dollar Tree, Inc. (DLTR), Autodesk, Inc. (ADSK), Analog Devices, Inc. (ADI).

Wednesday: Deere & Company (DE).

Source: Zacks, November 18, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.