The Weekly Update

Week of May 27th, 2025

By Christopher T. Much, CFP®, AIF®

Stocks moved lower last week as fiscal fears and fresh tariff threats loomed over market sentiment.

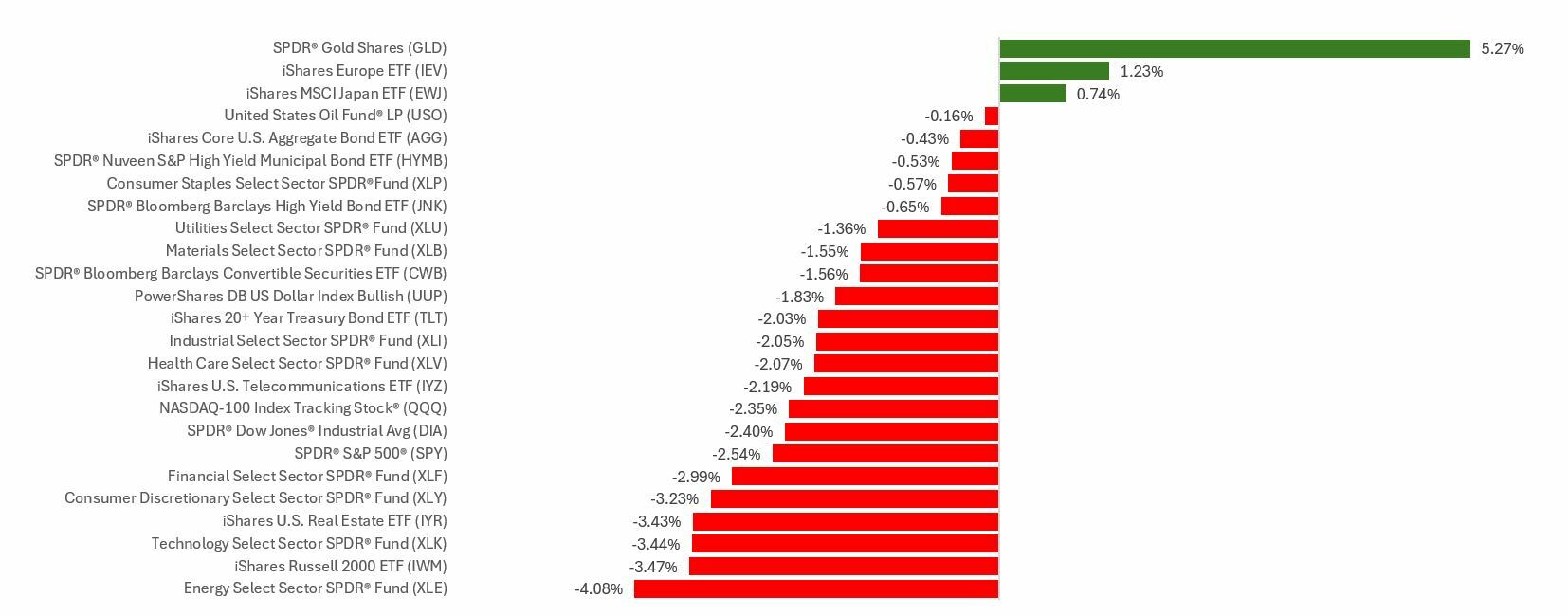

The Standard & Poor’s 500 Index fell 2.61 percent, while the Nasdaq Composite Index dropped 2.47 percent. The Dow Jones Industrial Average slid 2.47 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, advanced 1.14 percent.

Stocks Slip

On Monday, stocks were under a bit of pressure after credit rating agency Moody’s downgraded the U.S. as an issuer of government bonds.

Stocks remained under pressure midweek as Treasury yields moved higher with the 30-year bond hit a 19-month high. Investors fretted about the budget deficit; some feared the deficit would be made worse by the spending bill winding its way through Congress. After the House of Representatives approved the bill, bond yields backed off their highs and stocks went sideways.

On Friday, stocks dropped after President Trump warned of a 50 percent tariff on European Union goods following an apparent stall in trade negotiations. At the same time, the administration also threatened a 25 percent tariff on any iPhones manufactured outside of the U.S.7Expect traders to continue to closely watch economic reports to better understand whether tariffs are showing up in the data.

Unexpected Tariff News

The president’s fresh tariff talk ended a week or so of relative tranquility on the trade front. While the EU tariff threat may end with a deal like deals with other countries and regions, the iPhone issue may prove stickier.

Some analysts estimate that making iPhones in the U.S. would increase manufacturing costs by as much as 50 percent, which might increase the price of an iPhone.

This Week: Key Economic Data

Monday: Market Holiday

Tuesday: Durable Goods. New York Fed President John Williams and Minneapolis Fed President Neel Kashkari speak. Case-Shiller Home Price Index. Consumer Confidence.

Wednesday: Federal Open Market Committee (FOMC) Meeting Minutes. Neel Kashkari speaks.

Thursday: Gross Domestic Product (GDP). Jobless Claims (weekly). San Francisco Fed President Mary Daly and Chicago Fed President Austan Goolsbee speak. Fed Balance Sheet. Pending Home Sales.

Friday: Personal Consumption & Expenditures (PCE) Index. International Trade Balance in Goods. Atlanta Fed President Raphael Bostic and Austan Goolsbee speak. Retail and Wholesale Inventories. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; May 23, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: NVIDIA Corporation (NVDA), Salesforce Inc. (CRM)

Thursday: Costco Wholesale Corporation (COST), Dell Technologies Inc. (DELL)

Source: Zacks, May 23, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.