The Weekly Update

Week of August 21, 2017

By Christopher T. Much, CFP®, AIF®

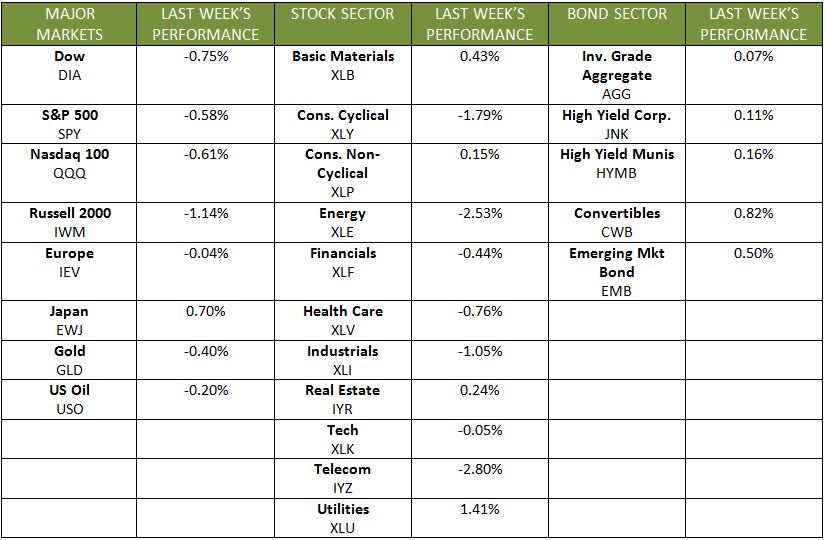

From domestic unrest to international terrorism, last week provided many headlines that could easily rattle the markets. While we did see days with volatility and declines, the major indexes remained relatively flat. For the week, the Dow was down 0.84%, the S&P 500 dropped 0.65%, and the NASDAQ fell 0.64%. On the international front, the MSCI EAFE remained virtually the same last week as the week before, recording a microscopic 0.0014% increase.

Why didn’t the markets react to the geopolitical turmoil by turning sharply negative? As we’ve shared before: Headlines shouldn’t drive long-term market behavior—economic fundamentals should. Last week, we received reports indicating the economy continues to be strong in a number of areas.

Here is a closer look at last week’s important economic news:

- Robust Retail Sales: July retail sales rose 0.6%, beating expectations and showing strength in a variety of retail categories.

- Strong Business Inventories: Factory, warehouse, and retail business inventories all jumped for a combined 0.5% increase in June. The data looks promising—inventory levels tend to rise in positive economic environments.

- Uneven Industrial Activity: Industrial production rose 0.2% in July. This growth was lower than expected due to declining motor vehicle production dragging on the index.

- Mixed Housing Data: The housing market index surged by 4 points as homebuilders experience an increasing demand from buyers. But despite the growing appetite for new construction, July’s housing starts slipped, in part because builders are struggling to find experienced labor and new sites to build on.

Looking Ahead

This week, we will receive more data that helps deepen our perspectives on housing market health, Q3 expectations, and the Fed’s upcoming plans.

In this time of dramatic headlines and geopolitical uncertainty, we want to remind you that you are in control of your wealth and financial future. No matter what the talking heads want you to believe, stay focused on market fundamentals. Please call or email if you have any questions concerning specific market data or larger, developing issues.

ECONOMIC CALENDAR

Wednesday: New Home Sales

Thursday: Jobless Claims, Existing Home Sales

Friday: Durable Goods Orders, Janet Yellen Speaks