The Weekly Update

Week of March 20th, 2023

By Christopher T. Much, CFP®, AIF®

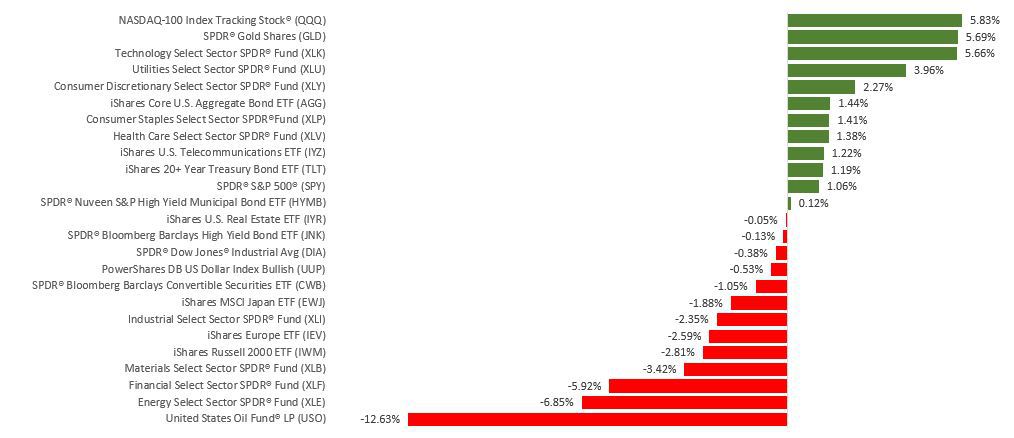

Amid the reverberations of two U.S. banks being taken over by regulators and the spread of uncertainty to European banks, stocks trended higher last week on the strength of the technology sector.

The Dow Jones Industrial Average was flat (-0.15%), while the Standard & Poor’s 500 rose 1.43%. The Nasdaq Composite index picked up 4.41%. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 3.12%.

Stocks Gain Despite Banking Woes

Stock prices gyrated as investors wrestled with banking troubles that appeared to spread to Europe. Worries of financial instability rocked financials and sent bond yields falling. While the rush into Treasuries was expected, the dash into technology stocks was a surprise. Falling yields made the high-growth names more attractive, though investors targeted their buying in high-quality companies that offered defensive characteristics, such as profits, healthy cash flows, and strong balance sheets.

When Switzerland’s central bank provided a lifeline to a troubled Swiss bank, and a group of U.S. banks provided aid to a struggling regional bank, stocks powered higher on Thursday. Banking jitters, however, returned on Friday, closing out a tumultuous week and paring some of the week’s gains.

Reverse Psychology

Less than two weeks ago, Fed Chair Jerome Powell testified interest rates might have to be hiked higher and faster. Since then, two U.S. banks were placed in receivership, sparking worries of financial instability, and changing the market’s outlook on future rate hikes.

The question now is if the Fed will hike short-term rates at all. By Thursday, traders saw an 18.1% probability of no rate increase at the March Fed meeting, which concludes this Wednesday. Just a week ago, it was a 0% chance. Traders also see a 0% chance of a 50 basis point rate increase in March. A week earlier, there was a 68.3% probability. Where the market previously saw little likelihood of a rate cut this year, the probability of a rate cut by July was 63.7% by Thursday.

This Week: Key Economic Data

Tuesday: Existing Home Sales.

Wednesday: FOMC Announcement.

Thursday: Jobless Claims. New Home Sales.

Friday: Durable Goods Orders. Purchasing Managers’ Index (PMI) Composite Flash.

Source: Econoday, March 17, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Nike, Inc. (NKE).

Thursday: General Mills, Inc. (GIS), Darden Restaurants, Inc. (DRI).

Source: Zacks, March 17, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.