The Weekly Update

Week of August 28, 2017

By Christopher T. Much, CFP®, AIF®

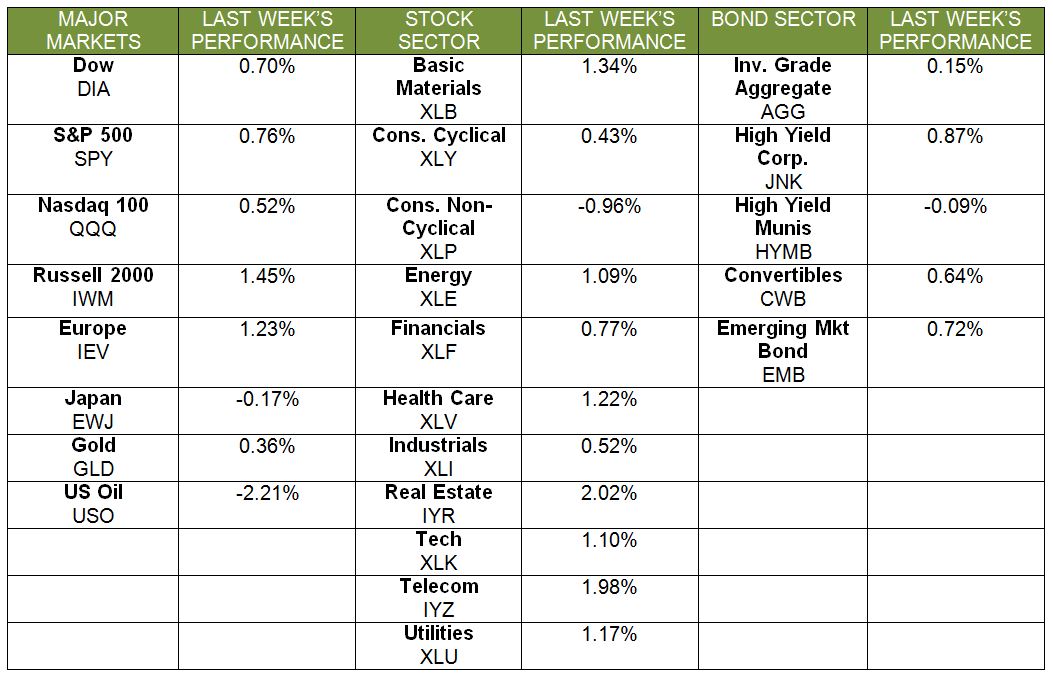

After several weekly losses, the major domestic indexes all ended in positive territory on Friday, August 25. The S&P 500 gained 0.72%, the Dow was up 0.64%, and the NASDAQ added 0.79% for the week. International stocks in the MSCI EAFE also increased by 0.58%.

Last week provided a number of economic updates, and a report from Fed Chair Janet Yellen helped push the markets higher. Rather than providing a rundown of every report, we want to focus on two in particular that give key information on economic health—and a reminder to look beyond the headlines.

Beyond the Headlines in Housing and Manufacturing

1. Housing Drops

The headlines: Sales of both new and existing homes fell in July.

The deeper story: Relatively few existing houses are available for purchase. In addition, builders are focusing on more lavish new homes rather than the modest ones that many buyers seek. As a result, the median price of a new home hit its highest July level ever, climbing to $313,700—6% higher than this time last year. Existing home prices are also 6.2% above where they were in July 2016.

The takeaway: High prices may be excluding first-time homebuyers from the market—especially for new houses.

2. Manufacturing Declines

The headlines: Durable goods orders plunged by 6.8%.

The deeper story: The headline’s stated monthly decline is largely due to a sharp drop-off in orders for transportation equipment, in particular for civilian aircraft. However, if you dig deeper, you will see that July’s civilian aircraft decrease follows a massive 129.3% increase in June, calming any concerns about the aircraft industry. Overall, orders for core goods beat expectations and could help drive a higher reading for second quarter GDP.

The takeaway: Orders and shipments for many key goods increased in July, which points to positive sentiment among businesses—and good news for the economy.

On the Horizon

This week, we will receive the second reading of second-quarter GDP, as well as both Consumer Confidence and Consumer Sentiment updates. Furthermore, according to President Trump’s Chief Economic Advisor, an announcement on tax reforms will occur on August 30. Together, these reports could affect market behavior and indicate both where the economy has been and what may be on the horizon.

As always, while we pay attention to today’s headlines and updates, our focus remains solidly on how to move you toward the future you desire. Should you have any questions, we are here to help.

ECONOMIC CALENDAR

Tuesday: Consumer Confidence

Wednesday: GDP, ADP Employment Report

Thursday: Personal Income and Outlays

Friday: Motor Vehicle Sales, PMI Manufacturing Index, ISM Mfg Index, Consumer Sentiment