The Weekly Update

Week of July 3, 2017

By Christopher T. Much, CFP®, AIF®

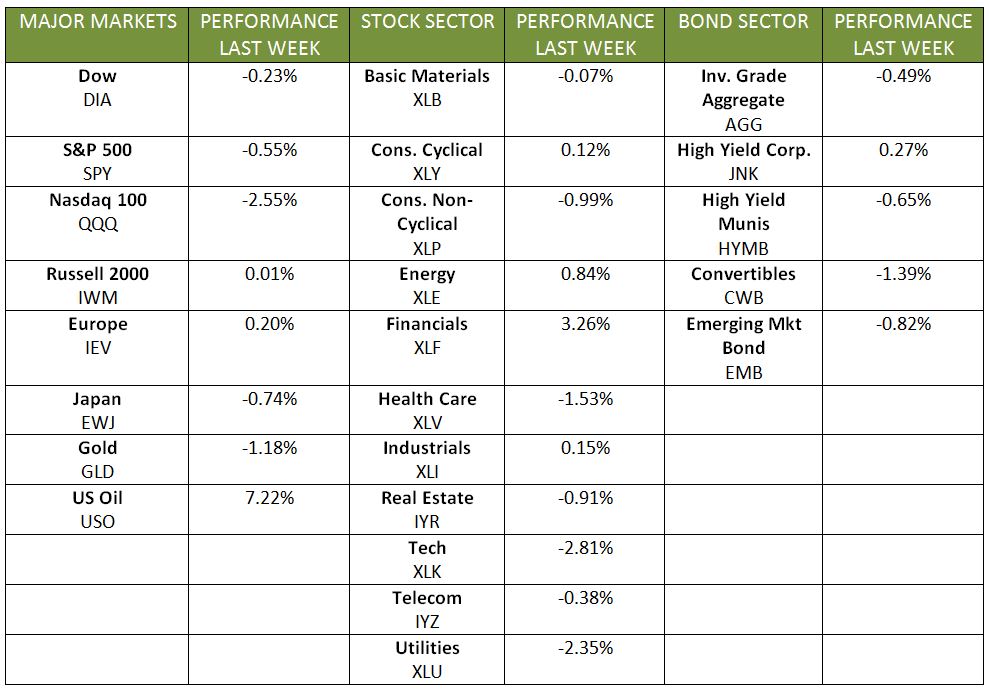

As Q2 ended, markets hit a six-week volatility high. While the tech sector declined during the week, consumer discretionary and industrial sectors drove stocks higher on Friday. On Friday, the tech-heavy NASDAQ slumped 1.99%. The S&P fell 0.61% and the DOW dropped 0.21%. Globally, the MSCI EAFE declined 0.32%, and European markets and most of the Asian markets finished the week down.

The Fed reported during the week that the largest U.S. banks passed the stress test evaluating their financial soundness. The test results indicate that banks have the capital structures to withstand difficult economic times. In addition, the results gave banks a green light to pay shareholders dividends and engage in share buybacks.

Other Market News

- Q1 Gross Domestic Product Numbers Go Up: The Q1 GDP estimate improved to 1.4% on an annualized basis. Previous estimates were 1.2% and 0.7%. Consumer spending was also revised upward to 1.1% from previous estimates of 0.6% and 0.3%.

- Durable Goods Orders Fall: Weakening commercial aircraft sales contributed to a 1.1% fall in May’s durable goods orders. Core capital goods also fell 0.2%, surprising expectations for a 0.5% increase.

- Consumer Confidence and Sentiment Rise: Consumer confidence exceeded expectations by 2 points in June as individuals who reported that jobs are difficult to find fell by 0.3%. The Consumer Sentiment Index rebounded in the second half of June to 95.1, but remains less than May’s 97.1 reading.

- Pending Home Sales Weaken: Despite an expected 0.5% gain, pending home sales dropped 0.8% in May. The 3-month run of slowing sales suggests a weakening housing sector.

- Home Price Index Softens: The Home Price Index fell from an annual increase of 5.9% to 5.7% year-over-year. This index reflects monthly changes in housing prices over 20 metropolitan regions. San Francisco, Boston, and Cleveland all reported lower housing price data.

- Oil Prices Climb: Although oil prices ended last Friday at $46.04 a barrel, oil closed the first-half of the year down 14%, its weakest performance since 1998. Ongoing concerns about an oversupplied market continue to influence investors despite a dip in U.S. production slowing the bearish outlook.

- Import/Export Data Modestly Brightens: Imported goods dropped to $193 billion and exports improved to $127.1 billion in May. While the $65.9 billion difference remains significant, this quarter’s goods gap is averaging $66.5 billion a month.

- The Dollar Drops: Though marginally recovering on Friday, the U.S. dollar reported its largest quarterly decline in almost 7 years against other major currencies.

The Week Ahead

U.S. markets close on Tuesday for the July 4th holiday. During the shortened trading week, the markets will look at manufacturing indices, motor vehicle sales, and employment data reports. As the data becomes available, investors will focus on how Q2 numbers roll out and what might be developing for the rest of the year.

As you reflect on this data and the week ahead, feel free to contact us should questions arise. CTS Financial Group is here to serve your complete financial goals and help you navigate your investing choices. We wish you and yours a happy and safe 4th of July holiday.

ECONOMIC CALENDAR

Monday: ISM Manufacturing Index, PMI Manufacturing Index, Motor Vehicle Sales, Construction Spending

Wednesday: Factory Orders

Thursday: ADP Employment Report, ISM Non-Mfg Index

Friday: Employment Situation