The Weekly Update

Week of February 19th, 2024

By Christopher T. Much, CFP®, AIF®

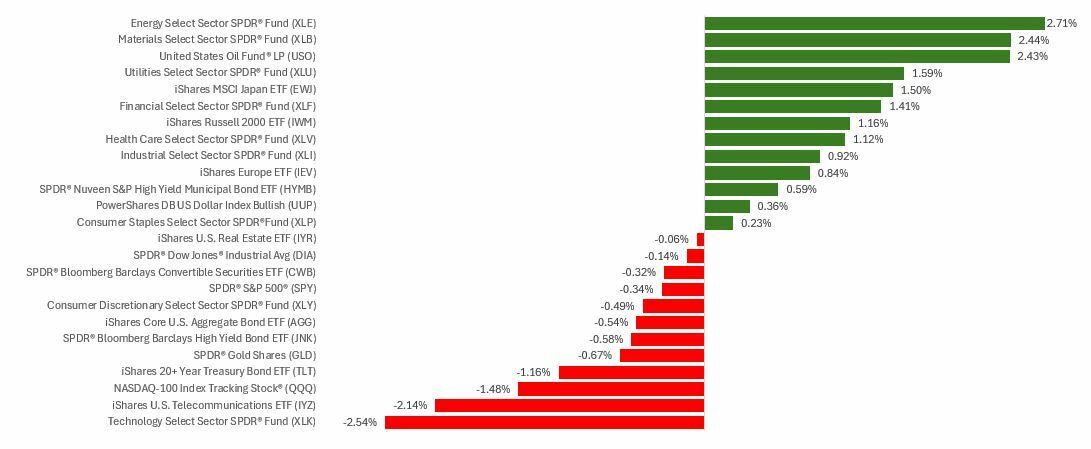

Stocks fell last week as investors reacted to disappointing inflation updates and other economic reports that fell short of estimates.

Stocks Snap Winning Streak

Markets were quiet Monday but opened lower Tuesday in response to the January inflation report that showed higher-than-expected consumer prices. But stocks regained some momentum on Wednesday and rallied Thursday despite disappointing reports on both retail sales and industrial production for January.

News of higher-than-expected wholesale prices on Friday put investors back on edge and kept stocks from ending the week on a positive note. The weekly loss broke a five-week winning streak.

Inflated Perspective

Consumer Price Index data was one of the big pieces of news driving markets last week, with January’s numbers coming in at 3.1 percent compared to a year prior—cooler than December’s 3.4 percent year-over-year gain but warmer than the 2.9 percent consensus. Jittery Investors focused on the hotter-than-expected part.

With the consumer report closely followed by disappointing inflation news on the producer level, attention quickly shifted to the Fed and what’s next for interest rates. While the Fed has indicated short-term rates may trend lower in 2024, the January inflation reports support Fed Chair Powell’s recent comments that the Fed is in no hurry to cut rates.

This Week: Key Economic Data

Tuesday: Leading Indicators.

Wednesday: FOMC Meeting Minutes.

Thursday: Jobless Claims. Existing Home Sales. U.S. Fed Balance Sheet.

Source: Econoday, February 15, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Walmart Inc. (WMT), The Home Depot, Inc. (HD), Palo Alto Networks, Inc. (PANW)

Wednesday: NVIDIA Corporation (NVDA)

Thursday: Intuit Inc. (INTU), Booking Holdings Inc. (BKNG)

Friday: Berkshire Hathaway Inc. (BRK.A, BRK.B)

Source: Zacks, February 15, 2024

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.