The Weekly Update

Week of November 25th, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks declined last week as mixed signals emerged about the progress of U.S.-China trade negotiations.

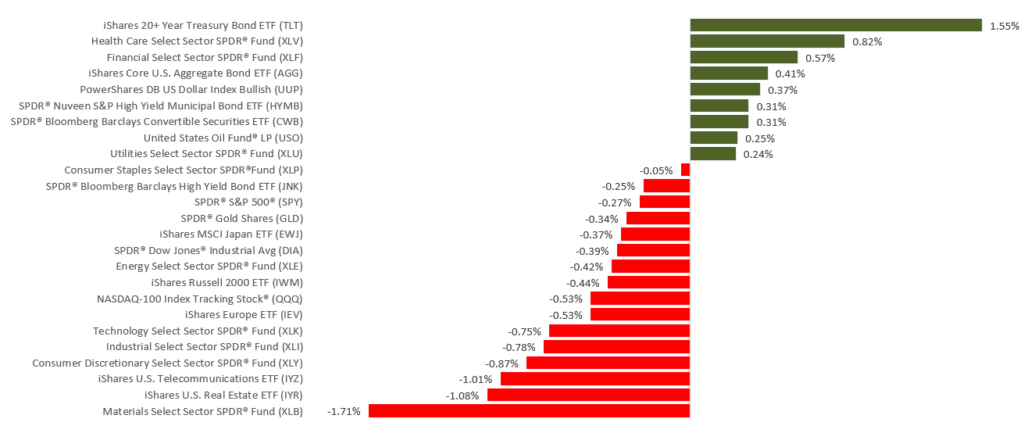

The three major Wall Street benchmarks all took weekly losses. The Dow Jones Industrial Average declined 0.46%; the S&P 500, 0.33%, the Nasdaq Composite, 0.25%. Also pulling back, the MSCI EAFE index, tracking developed stock markets outside the U.S. and Canada, retreated 0.69%.

Nothing Conclusive Regarding Trade

As the market week ended, there was still haziness surrounding the state of U.S.-China trade discussions. Were negotiators on the cusp of a phase-one deal or further away?

Friday, President Trump told reporters that a deal was “very close,” but Chinese President Xi Jinping said that his country could decide to “fight back” against certain terms. Last week, a bill intended to support Hong Kong protesters advanced through Congress, and that development was not taken well in Beijing.

The Fed Assesses the Economy

Federal Reserve officials gathered for their October meeting “generally saw the economic outlook as positive” according to minutes from the central bank’s October monetary policy meeting released Wednesday. Some of them termed the economy “resilient.”

The minutes also noted that the Fed would wait to assess the impact of its recent interest rate cuts and that any upcoming policy decisions might be data dependent.

Strength in the Housing Sector

Existing home sales improved 1.9% last month, by the estimation of the National Association of Realtors. Year-over-year, sales were up 4.6% through October, and the median sale price was $270,900, 6.2% above where it was 12 months earlier.

Wednesday, the Census Bureau said that single-family home construction increased for a fifth straight month in October. In addition, the pace of building permits for new homes hit a level unseen since 2007.

What’s Ahead

This will be an abbreviated trading week on Wall Street. U.S. stock and bond markets are closed on Thanksgiving Day (Thursday), and then reopen for a half-day session on Friday.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Census Bureau issues its latest new home sales snapshot, and the Conference Board releases its November Consumer Confidence Index.

Wednesday: October consumer spending numbers appear from the Department of Commerce, and the Bureau of Economic Analysis publishes a new estimate of third-quarter economic expansion.

Source: Econoday, November 22, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Agilent (A), Hewlett-Packard (HPE), Palo Alto Networks (PANW)

Tuesday: Analog Devices (ADI), Dell Technologies (DELL), Vmware (VMW)

Wednesday: Deere & Co. (DE)

Source: Zacks, November 22, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.