The Weekly Update

Week of December 4, 2017

By Christopher Much, CFP®, AIF®

Markets went for a wild ride last week—especially on Friday. In fact, on December 1, the S&P 500 had its largest fluctuations since the day after the 2016 presidential election.

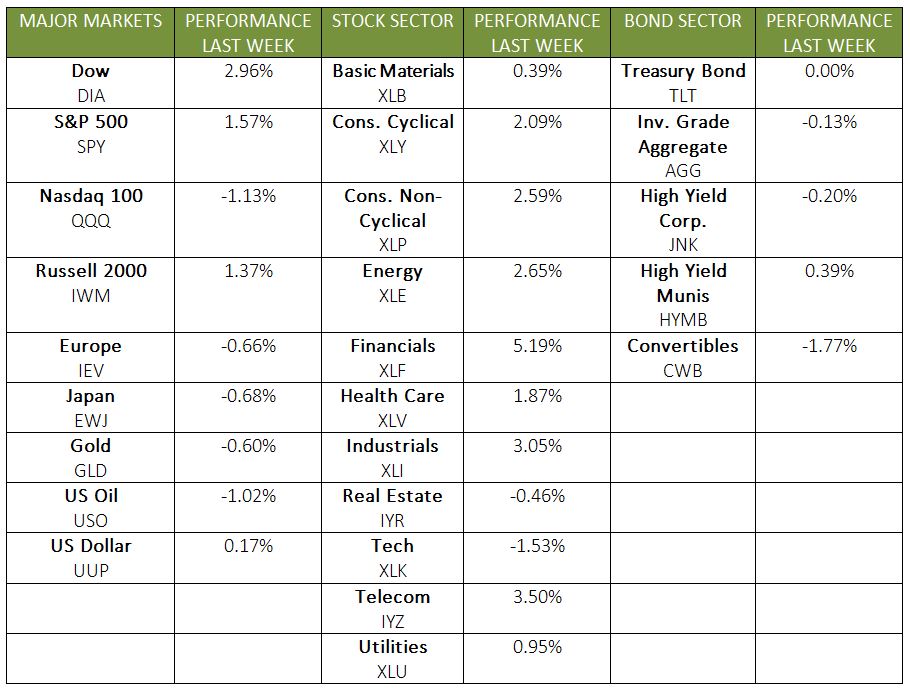

Nonetheless, two of the major domestic markets hit new record highs on Thursday and ended the week with sizable gains. The S&P 500 added 1.53% and the Dow gained 2.86%. Meanwhile, the NASDAQ lost 0.60% and international stocks in the MSCI EAFE gave back 0.95%.

What drove markets last week?

Politics played a large role in market performance last week with big developments on tax reform and the Russia investigation.

- Tax Reform

On Thursday, news that the Senate bill was more likely to pass contributed to the Dow and S&P 500 closing at record highs. Early Saturday morning, the Senate did end up voting in favor of the proposal. - Russia Investigation

On Friday, stocks dropped on news that former National Security Adviser Michael Flynn pleaded guilty to charges of lying to the FBI.

While politics grabbed many of the headlines, we also received economic updates that are worth noting:

- Gross Domestic Product

We received the 2nd GDP reading for July – October, and the report came back higher than expected. During the 3rd quarter, the economy grew at 3.3%, which is its quickest pace in 3 years. - Housing Sales

New home sales beat expectations in the most recent report and increased 18.7% year over year. The sales were higher than they’ve been in a decade. - Consumer Spending

Americans spent and earned more money in October, according to the data we received last week.

What should you focus on?

Political developments are affecting daily market performance, so we understand the interest they hold. While you may be following these reports, we also want to ensure you recognize the economic data coming forward, too.

We cannot predict what will happen with tax reform or the Russia investigation. However, we can continue to monitor them while focusing on what’s really happening in the economy beyond the headlines. If you ever have questions about how current events may affect your financial life, please contact us any time.

ECONOMIC CALENDAR

Monday: Factory Orders

Tuesday: ISM Non-Mfg Index

Wednesday: ADP Employment Report

Thursday: Jobless Claims

Friday: Consumer Sentiment