The Weekly Update

Week of July 9, 2018

By Christopher T. Much, CFP®, AIF®

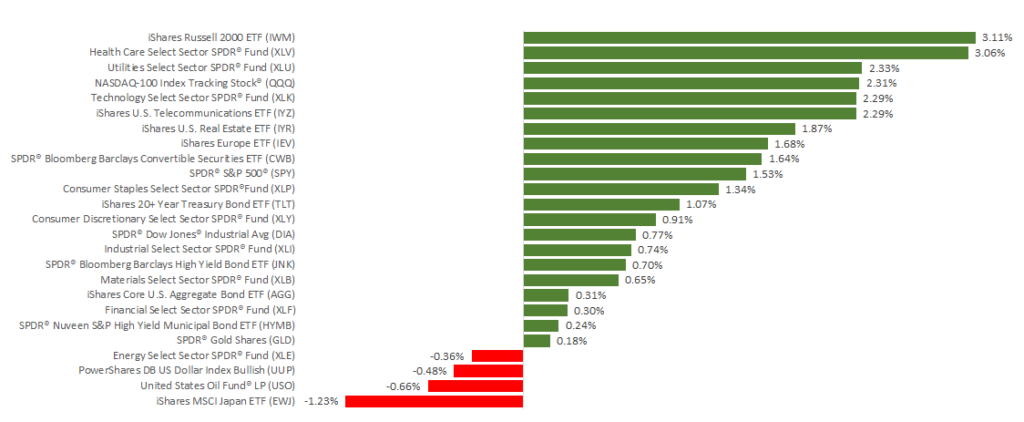

Domestic stocks only traded for 4 days last week, due to the Independence Day holiday. In that time, all 3 major domestic indexes posted positive results for the week. The S&P 500 added 1.52%, the Dow gained 0.76%, and the NASDAQ increased 2.37%. International stocks in the MSCI EAFE were up as well by 0.56%.

Once again, trade and tariffs were a major topic on many people’s minds. On Friday, July 6, the U.S. and China placed $34 billion of duties on each other’s imports. However, instead of focusing on the trade-war escalation, another topic captured many investors’ attention: the latest jobs report.

What did we learn about the labor market?

This month’s report about the employment situation provided several indications that the economy continues to be healthy and growing.

1. The economy added more jobs than expected.

Economists predicted approximately 195,000 new jobs in June. Instead, the report showed that the economy added 213,000 new positions. This positive performance indicates the labor market may be somewhat looser than people originally thought. As a result, the economy may have more ability to continue growing without inflation becoming a bigger concern.

2. More people tried to enter the labor market.

Unemployment rose from 3.8% to 4% in June. On the surface, this result may seem negative. But, this increase comes from people who were sitting on the sidelines deciding to look for work once again. This choice indicates they feel more confident in their potential to find jobs.

3. Wage growth continued at a moderate pace.

The latest data revealed wage growth at a 2.7% annual pace, which was slightly below projections. Economists aren’t certain why wages are growing at such a tepid rate, considering the labor market’s strength. However, with a record number of open jobs, wage growth should increase later this year. In addition, June’s pace should help calm concerns about the economy growing too quickly.

One detail that June’s employment report didn’t show was any meaningful, negative impacts from tariffs. If the trade disputes continue, however, industries such as manufacturing and construction could suffer. For now, the economy is starting the 3rd quarter on relatively strong footing—after a 2nd quarter that experts say could have experienced economic growth as high as 5%.

We will continue to monitor ongoing trade developments for any lasting effects on the economy or our clients’ financial lives. As always, if you have any questions, we’re here to talk.

ECONOMIC CALENDAR:

Tuesday: JOLTS

Thursday: Consumer Price Index, Jobless Claims

Friday: Consumer Sentiment