The Weekly Update

Week of December 7th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks marched higher last week on an improving outlook for the passage of a fiscal stimulus package.

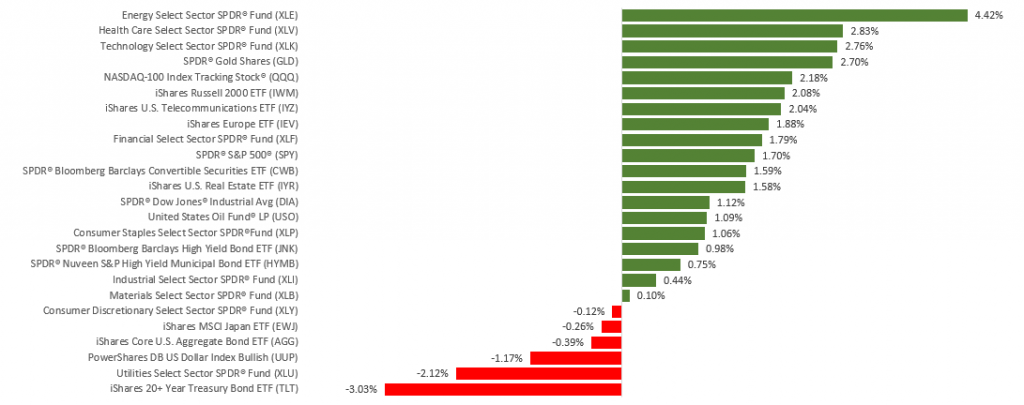

The Dow Jones Industrial Average rose 1.03%, while the Standard & Poor’s 500 tacked on 1.67%. The Nasdaq Composite index gained 2.12% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.78%.

A Record Week for Stocks

After opening the week with moderate losses amid rising COVID-19 infections, stocks turned higher as investor sentiment was buoyed by the resumption of fiscal stimulus negotiations. As lawmakers discussed various proposals, stocks managed to grind higher.

A better-than-expected jobless claims report on Thursday added fuel to the market rally, but the gains evaporated in late-day trading following news by a major pharmaceutical company that it would be slowing its rollout of the vaccine due to logistical challenges.

A disappointing jobs report on Friday did not keep investors from bidding stocks higher as the week came to a close, sending the Dow Jones Industrials, S&P 500, and the NASDAQ Composite indices to record high closes.

The Start of Holiday Shopping

The start of the holiday shopping season provides important insight into the state of the economy and overall consumer confidence. In response to the pandemic, consumers avoided in-store visits over the Thanksgiving weekend. This translated into a 22.4% decline in spending from last year’s levels.

However, spending prior to the Thanksgiving-to-Sunday period surged 65.7% from a year earlier, thanks to large retailers introducing Black Friday-like deals as early as mid-October.

Of course, the pandemic has led to an acceleration in shopping online. Cyber Monday sales jumped 15.1% over last year’s levels as consumers spent almost $11 billion, making it the largest U.S. online shopping day ever.

THIS WEEK: KEY ECONOMIC DATA

Wednesday: Gross Domestic Product (GDP), Job Openings and Labor Turnover Survey (JOLTS).

Thursday: Consumer Price Index (CPI), Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, December 4, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Coupa Software (COUP)

Tuesday: Autozone (AZO), Mongodb, Inc. (MDB), Chewy, Inc. (CHWY)

Wednesday: Campbell Soup Company (CPB), Slack Technologies (WORK)

Thursday: Lululemon Athletica, Inc. (LULU), Adobe, Inc. (ADBE), Broadcom (AVGO), Costco Wholesale Corp. (COST)

Source: Zacks, December 4, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.