The Weekly Update

Week of September 2nd, 2025

By Christopher T. Much, CFP®, AIF®

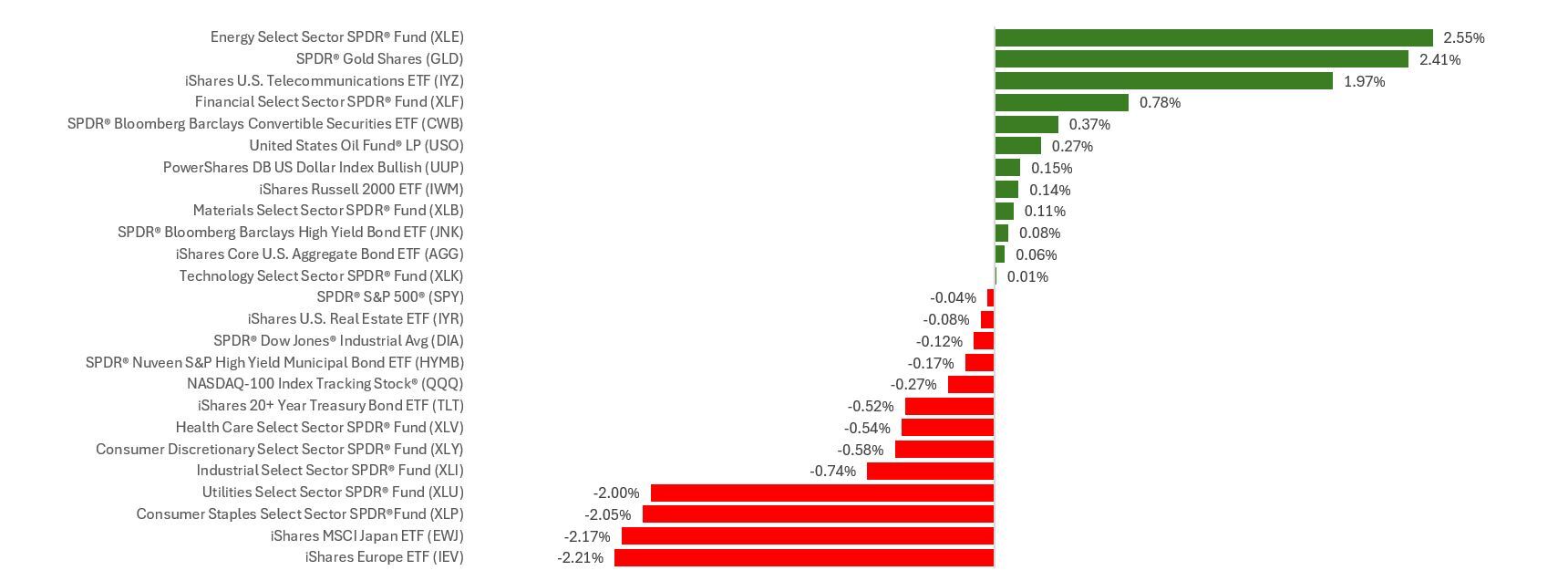

Stocks ended the week slightly lower as mixed economic data led to some profit-taking by investors ahead of the holiday weekend.

The Standard & Poor’s 500 Index edged down 0.10 percent, while the Nasdaq Composite Index slipped 0.19 percent. The Dow Jones Industrial Average slid 0.19 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, skidded 1.53 percent.

Stocks Rise, Then Falter

Stocks initially rose but then took a breather as investors continued to process Fed Chair Powell’s comments from the Fed’s annual symposium.

Stocks regained momentum midweek as investors waited for the Q2 corporate report from the nation’s most influential artificial intelligence (AI) company. The AI chip maker posted results Wednesday night, with a mixed reception in after-hours trading. On Thursday, the stock rallied, which helped the S&P 500 close above 6500 for the first time.

On Friday, the Fed’s favorite inflation gauge, the Personal Consumption Expenditures (PCE) Index, aligned with expectations. Still, stocks were under pressure from the opening bell as investors appeared to take profits ahead of the Labor Day weekend.

Mixed Economic News

Revised gross domestic product (GDP) numbers showed the economy grew more quickly in Q2 than initially thought, which was a win for the economic bulls. However, the economic bears pointed out that orders of durable goods declined and the trade deficit was wider than expected. The PCE report, while in line with expectations, was at a 2.9 percent annual rate in July.

Investors are closely watching every piece of economic data for insights into what the Fed will do with interest rates at its two-day meeting, which ends September 17. So, expect attention to focus on speeches by Fed officials until the Fed enters its blackout period before the September meeting.

This Week: Key Economic Data

Monday: MARKET HOLIDAY

Tuesday: ISM Manufacturing. Construction Spending.

Wednesday: Job Openings. Factory Orders. Fed Beige Book. Auto Sales. Minneapolis Fed President Neel Kashkari speaks.

Thursday: ADP Employment Report. Weekly Jobless Claims. Productivity. Trade Deficit. ISM Services. New York Fed President John Williams and Chicago Fed President Austan Goolsbee speak.

Friday: Jobs Report.

Source: Investor’s Business Daily – Econoday economic calendar; August 29, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Salesforce Inc. (CRM)

Thursday: Broadcom Inc. (AVGO)

Source: Zacks, August 29, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.