The Weekly Update

Week of February 5th, 2024

By Christopher T. Much, CFP®, AIF®

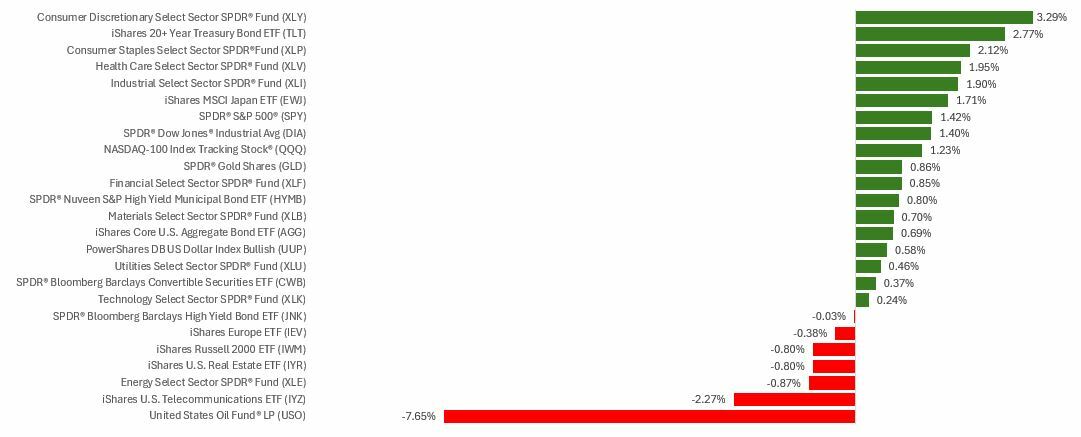

Stocks pushed higher last week as investors cheered mega-cap tech corporate reports and a better-than-expected employment report.

Stocks At New Highs

At the beginning of the week, stocks surged, anticipating fourth-quarter corporate updates from tech companies and the Federal Reserve’s two-day policy meeting; this led to the S&P 500 Index reaching a new record high on Monday.

The market remained relatively stable for the rest of the week until Wednesday, when the Federal Reserve announced its decision to maintain interest rates within the 5.25-5.50 percent target range. The Federal Open Market Committee’s (FOMC) news unsettled investors, who anticipated that rates would remain unchanged but expected more specific guidance on the Fed’s plan to lower interest rates.

On Friday, the job report for January revealed the addition of 353,000 new jobs, surpassing the forecast of 185,000. This strong report did not negatively impact the markets. Instead, investors interpreted it as confirmation of a robust economy.

Fed’s Mixed Signals

The Fed’s decision to keep rates steady left some investors disappointed, as they had been hoping for indications of rate cuts in the coming months; this led to a decline in stock prices on Wednesday, with increased selling towards the end of the trading day.

The Wall Street Journal’s headline after the FOMC meeting on Wednesday suggested that rate cuts were possible but not expected immediately. The FOMC’s policy language, released after the meeting, indicated a subtle shift from considering rate cuts to proposing they could be possible unless inflation became a concern.

This Week: Key Economic Data

Monday: ISM Services Index.

Wednesday: International Trade in Goods & Services. EIA Petroleum Report.

Thursday: Jobless Claims. Fed Balance Sheet.

Source: Econoday, February 2, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: McDonald’s Corporation (MCD), Caterpillar (CPL)

Tuesday: Eli Lilly and Company (LLY), Amgen Inc. (AMGN), Fiserv, Inc. (FI)

Wednesday: The Walt Disney Company (DIS), Uber Technologies Inc. (UBER), PayPal Holdings Inc. (PYPL)

Thursday: AstraZeneca Plc (AZN), S&P Global Inc. (SPGI), Philip Morris International Inc. (PM)

Friday: PepsiCo Inc. (PEP)

Source: Zacks, February 2, 2024

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without