The Weekly Update

Week of January 18th, 2021

By Christopher T. Much, CFP®, AIF®

Markets drifted lower last week as uninspired investors digested mixed news on the economic front.

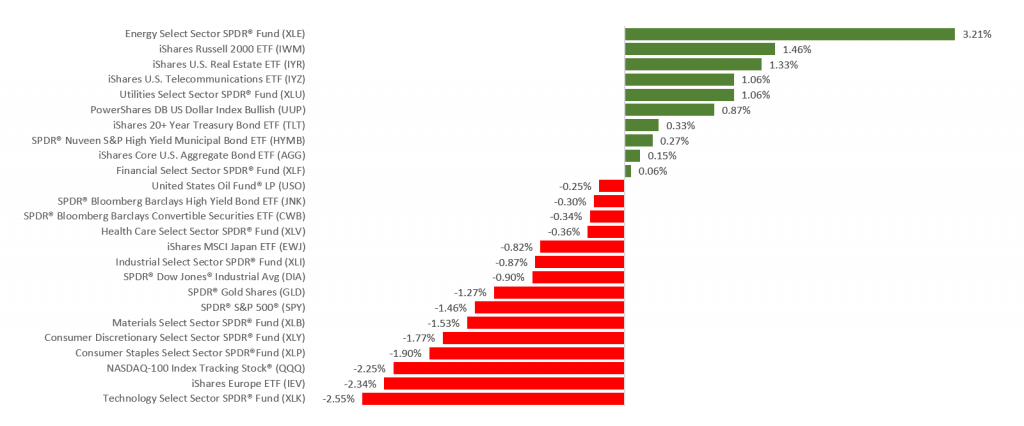

The Dow Jones Industrial Average lost 0.91% while the Standard & Poor’s 500 slid 1.48%. The Nasdaq Composite index stumbled 1.54% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.26%.

Stocks Drift Lower

Stocks traded without much conviction last week, pushed lower, in part, by a broad retreat in technology. Rising interest rates also dampened enthusiasm, feeding concerns over their effect on current stock valuations.

Markets seemed deaf to a stream of news, moving little on the House impeachment vote, encouraging news on the vaccine front, reassurances from Fed Chair Powell, or a jump in jobless claims. Energy and financials continued their recent advance, while smaller capitalization stocks rose on expectations of becoming beneficiaries of any stimulus bill.

Stocks turned lower to close the week, following the unveiling of president-elect Biden’s stimulus plan and a weaker-than-expected retail sales number.

New Stimulus Proposal

Biden revealed his long-anticipated stimulus proposal last week, announcing a $1.9 trillion spending plan to provide further help to an unsteady economy.

Along with monetary easing, fiscal stimulus has been one of the major drivers of the stock market recovery, which is why investors have anxiously awaited his plan.

His proposal seeks to help individuals, including direct payments for qualifying Americans and enhanced unemployment aid. The proposal would also include help for small businesses with a new grant program in addition to the Paycheck Protection Program, and would bolster state finances by funding frontline workers, vaccine distribution, reopening schools, and vital services.

The market reaction was muted. Investors will be watching the extent to which Congress amends Biden’s proposal and the speed at which it’s picked up by the legislature.

This Week: Key Economic Data

Thursday: Housing Starts. Jobless Claims.

Friday: Existing Home Sales. PMI (Purchasing Managers’ Index) Composite Flash.

Source: Econoday, January 15, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Netflix (NFLX), Bank of America (BAC), Goldman Sachs (GS), J.B. Hunt Transportation (JBHT).

Wednesday: UnitedHealth Group (UNH), Morgan Stanley (MS), United Airlines (UAL).

Thursday: IBM (IBM), CSX Corporation (CSX), Union Pacific (UNP).

Friday: Kansas City Southern (KSU), PPG Industries (PPG).

Source: Zacks, January 15, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.