The Weekly Update

Week of May 20th, 2024

By Christopher T. Much, CFP®, AIF®

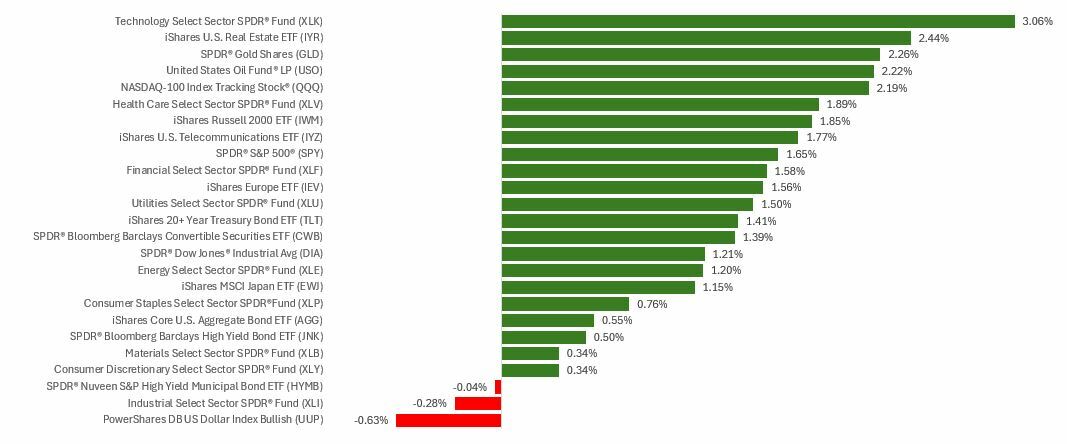

Stocks notched a solid gain last week in a mega-cap, tech-led rally bolstered by positive inflation news.

Dow 40,000

The week began quietly as market averages traded in a tight range, awaiting fresh inflation news.

On Tuesday, markets rose steadily throughout the day after digesting a mixed wholesale inflation report.

The next day, a cooler-than-expected Consumer Price Index (CPI) report sparked a broad-based rally as the upbeat news raised investors’ hopes for a rate cut. The Nasdaq Composite and Standard & Poor’s 500 (which ended above 5300 for the first time) closed the day up 1.4 percent and 1.2 percent, respectively. Meanwhile, the bellwether 10-year Treasury yield fell to 4.35 percent.

Investors took a break as the week ended, mostly yawning at mixed economic data. Notably, the Dow closed just above 40,000 on Friday.

Inflated Expectations

With the two critical inflation updates last week, attention shifted to the Federal Reserve’s next steps with interest rates.

The top-level CPI numbers (known as headline inflation) tend to be less important than what’s underneath: core inflation (CPI minus volatile food and energy prices) in the Fed’s eyes, Core CPI came in at 0.29 percent for April, just below the 0.30 percent from Wall Street. It was the first time the core CPI was lower than forecasts in three months. The news revived speculation that the Fed might consider a rate adjustment as early as September.

This Week: Key Economic Data

Monday: Fed Officials Michael Barr, Raphael Bostic, Christopher Waller, and Philip Jefferson speak for the first time.

Tuesday: Fed Officials Michael Barr, Raphael Bostic, Christopher Waller, and Philip Jefferson speak again. John Williams speaks for the first time this week.

Wednesday: Existing Home Sales. 20-Year Treasury Bond Auction. FOMC Meeting Minutes.

Thursday: Jobless Claims. New Home Sales. Fed Balance Sheet.

Friday: Durable Goods. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; May 17, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Palo Alto Networks, Inc. (PANW)

Tuesday: Lowe’s Companies, Inc. (LOW)

Wednesday: NVIDIA Corporation (NVDA), The TJX Companies, Inc. (TJX), Target Corporation (TGT)

Thursday: Intuit Inc. (INTU)

Source: Zacks, May 17, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.