The Weekly Update

Week of May 17th, 2021

By Christopher T. Much, CFP®, AIF®

A surge in consumer inflation unsettled investors, leading to a turbulent week of trading on Wall Street.

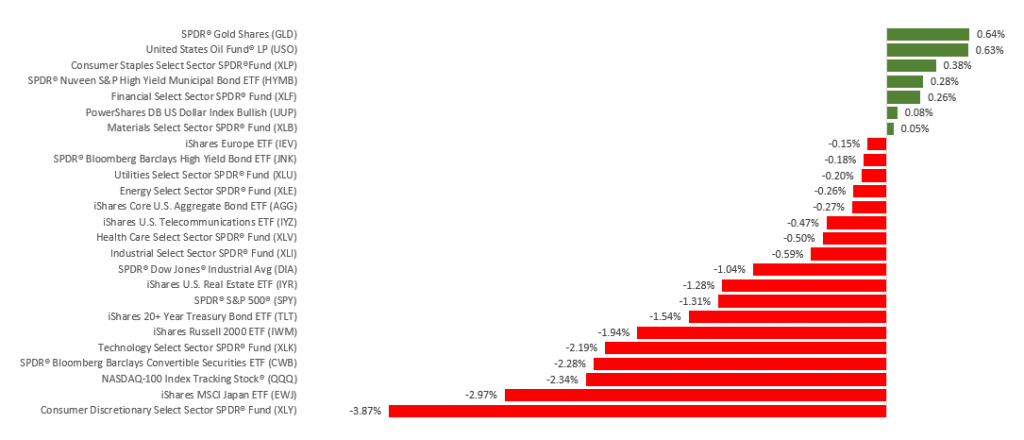

The Dow Jones Industrial Average slipped 1.14%, while the Standard & Poor’s 500 fell 1.39%. The Nasdaq Composite index dropped 2.34% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 3.02%.

Inflation Concerns

The market has been troubled recently by building inflationary pressures. Investors are concerned that rising prices may hurt corporate profits and force the Fed to tighten its monetary policy sooner than anticipated. Worse, investors fear the Fed may have to react more aggressively if it waits too long to act.

After back-to-back losses, the retreat in stock prices culminated on Wednesday, following the release of the higher-than-anticipated Consumer Price Index (CPI) report.

Stocks managed to claw back some of the week’s losses with a Thursday-Friday rebound, sparked by investors doing some bargain hunting.

Consumer Prices Spike

Wednesday’s release of April’s CPI inflamed investors’ inflation fears, as consumer prices rose 0.8% in April and jumped by 4.2% year-over-year. These numbers were above expectations.

April price increases were led by a remarkable 10% increase in used cars, with additional pockets of sharp increases, notably in transportation services and commodities. Perhaps equally concerning is that energy costs showed a decline during April, a price weakness that may reverse in the coming months.

Core inflation, which excludes the more volatile food and energy prices, was up a more modest 3.0% from April 2020.

This Week: Key Economic Data

Tuesday: Housing Starts.

Wednesday: FOMC (Federal Open Market Committee) Minutes.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Friday: Existing Home Sales. PMI (Purchasing Managers Index) Composite Flash.

Source: Econoday, May 14, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Walmart (WMT), The Home Depot (HD).

Wednesday: Cisco Systems (CSCO), Target (TGT), Lowes (LOW), JD.com (JD), The TJX Companies (TJX), Deere & Company (DE).

Thursday: Kohl’s Corporation (KSS), Ross Stores, Inc. (ROST), L Brands, Inc. (LB).

Source: Zacks, May 14, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.