The Weekly Update

Week of January 3rd, 2021

By Christopher T. Much, CFP®, AIF®

Stocks closed out the year on a mostly positive note, adding to the year’s gains as concerns about the economic issues of Omicron infections receded.

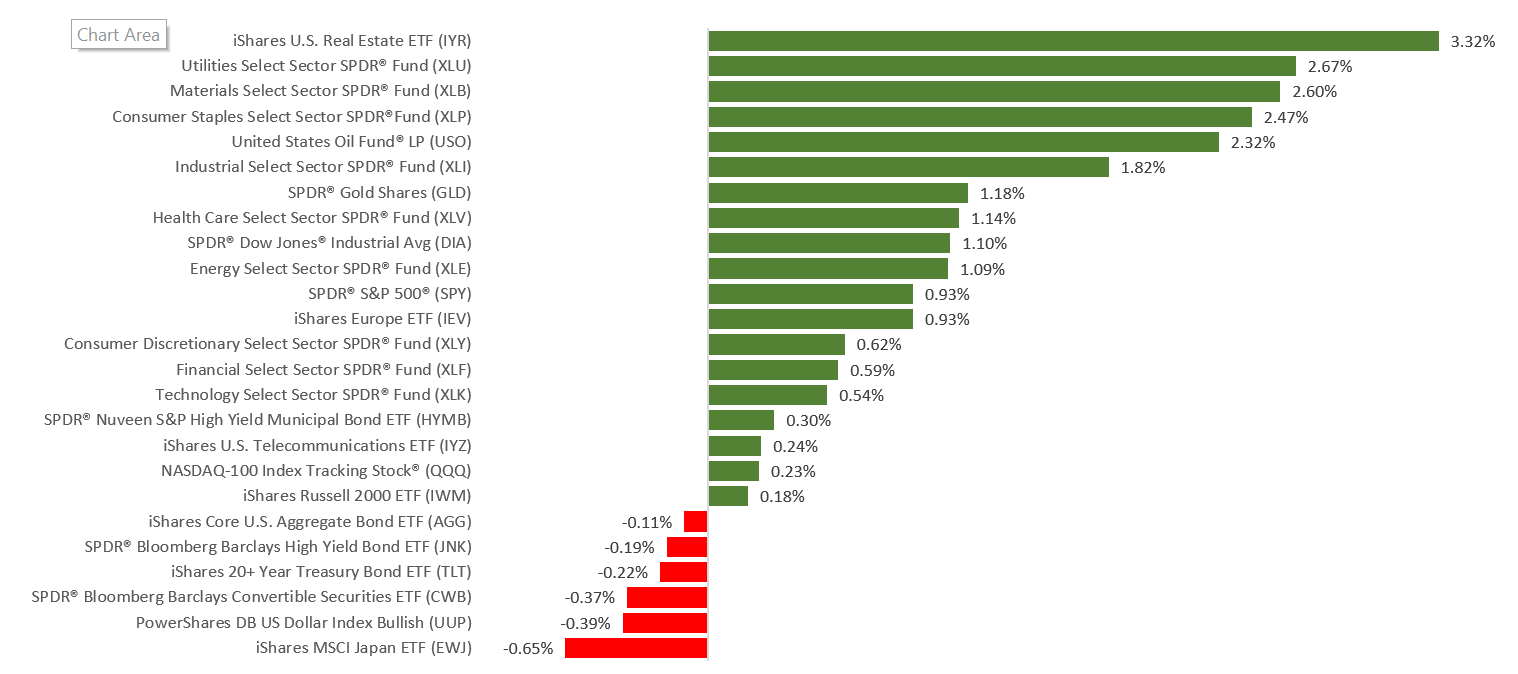

The Dow Jones Industrial Average rose 1.08%, while the Standard & Poor’s 500 picked up 0.85%. The Nasdaq Composite index was flat (-0.05%) for the week. The MSCI EAFE index, which tracks developed overseas stock markets, posted an increase of 0.80%.

Stocks Notch Record Highs

The end of the year is historically a strong period for stocks–a seasonal pattern dubbed “The Santa Claus Rally.” This year’s final week of trading did not disappoint as stocks posted healthy gains to kick off the week, despite a global increase in Omicron infections. Investors were buoyed by data that showed fewer associated hospitalizations, which helped ease fears of the variant’s economic impact.

The S&P 500 set multiple fresh record highs, with Wednesday’s new high representing the 70th such high in 2021, while the Dow Industrials recorded its first new record since November. Stocks drifted on low trading volume in the final two trading days of the year, capping a good week, a solid month, and a strong year for investors.

Robust Holiday Sales

The market got off to a good start last week in part due to a strong holiday sales report. A major credit card issuer reported that consumer holiday spending rose 8.5% from last year’s levels, driven by an 11.0% gain in online sales. It was the biggest annual increase in 17 years. The spending by consumers exceeded pre-pandemic sales by 10.7%. The retail categories that experienced the highest sales increases were apparel (+47.3%) and jewelry (+32.0%).

It was a particularly robust number in view of investor concerns about supply chain disruptions, port congestion, labor shortages, and wavering consumer confidence.

This Week: Key Economic Data

Tuesday: JOLTS (Job Openings and Turnover Survey). Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI).

Thursday: Jobless Claims. Factory Orders. Institute for Supply Management (ISM) Non- Manufacturing Purchasing Managers’ Index (PMI).

Friday: Employment Situation.

Source: Econoday, December 31, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Thursday: Constellation Brands, Inc. (STZ), Walgreens Boots Alliance, Inc. (WBA), Conagra Brands (CAG).

Source: Zacks, December 31, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.